In the rapidly evolving landscape of the insurance industry, fostering resilience and preparing for unforeseen challenges have become paramount. The integration of no-code platforms has emerged as a pivotal strategy in this regard, offering insurance enterprises a powerful tool to adapt, innovate, and thrive amidst uncertainty.

Adaptability and innovation through no-code solutions

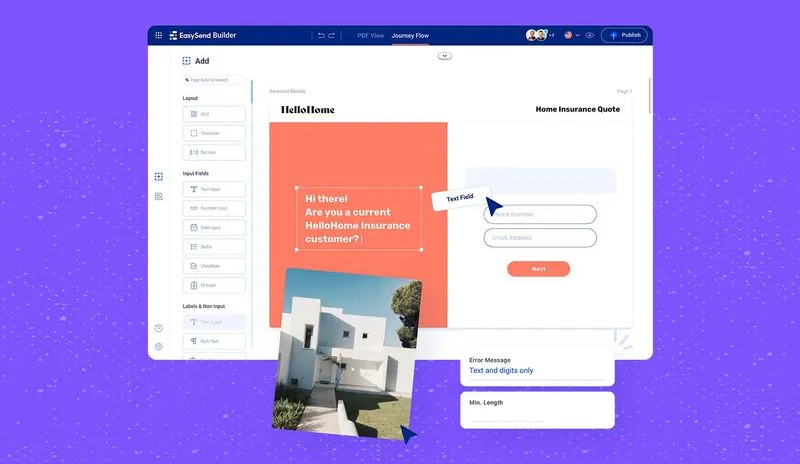

The rise of no-code and low-code platforms empowers insurers to unlock the benefits of cloud computing and microservices more easily, facilitating a nimble and responsive approach to market demands. These platforms allow insurance companies to reduce their IT backlogs and close the skill gap, making them more agile, competitive, and digitally oriented. This shift is not just about adopting new technology; it represents a holistic approach to IT, where insurance-specific data models and process logic coexist with versatile low-code platforms.

Addressing industry-specific challenges

Insurance companies often face internal obstacles like department silos and legacy IT systems, which hinder innovation and adaptation. No-code platforms can effectively address these challenges by simplifying and streamlining processes. For example, by eliminating the heavy lifting on the development side, these platforms enable insurers to focus on more value-adding projects, such as AI-enabled fraud detection and data insights.

Enhanced customer experiences and services

No-code platforms empower front-line insurance professionals in critical areas like pricing, distribution, and data enrichment. This tech enablement transforms front-end consumer experiences rapidly and at a low cost. Additionally, the flexibility of no-code systems in handling customer and policy data can break down silos of information, offering more personalized products and aligning with the retail-like approach adopted by other fintech industries.

No-code use-cases across policy life cycle

No-code solutions can be incredibly beneficial at various stages of the insurance policy lifecycle, offering streamlined processes, improved efficiency, and enhanced customer experiences. Here are several examples of situations where no-code platforms can be a lifesaver for insurers:

- Product Development and Customization: In the initial stages of product development, no-code platforms enable insurers to quickly design and launch new insurance products. Insurers can use no-code tools to customize policies to meet specific market needs or regulatory requirements without the need for extensive programming.

- Underwriting Process: No-code platforms can streamline the underwriting process by automating data collection and analysis. This automation allows underwriters to assess risks more accurately and quickly, leading to faster policy issuance and improved customer satisfaction.

- Policy Issuance and Management: No-code solutions can simplify the policy issuance process, making it faster and more efficient. They enable insurers to manage policy alterations, renewals, and cancellations with greater ease, reducing administrative burdens and improving accuracy.

- Claims Processing: In claims management, no-code platforms can be used to automate and streamline the claims process. They facilitate quicker claim registrations, efficient documentation management, and faster claims adjudication, leading to improved customer service during what is often a stressful time for policyholders.

- Customer Service and Support: No-code solutions can enhance customer service by providing tools for better communication, self-service portals, and automated responses to common queries. This leads to increased customer satisfaction due to faster and more accurate responses.

- Compliance and Reporting: Insurers face a constantly changing regulatory landscape. No-code platforms can assist in adapting to these changes quickly by enabling insurers to modify their systems to ensure compliance without extensive coding. They also facilitate easier and more accurate reporting.

- Data Analysis and Risk Management: No-code tools can help insurers in collecting and analyzing vast amounts of data, leading to better risk assessment and management. Insurers can use these insights to adjust their policies and practices, enhancing overall efficiency and profitability.

- Marketing and Customer Outreach: No-code platforms allow for the rapid development and deployment of marketing campaigns, tailored to specific customer segments. Insurers can quickly adapt their marketing strategies based on real-time data and customer feedback.

Real life examples

From healthcare insurance to bond submissions, companies have harnessed the power of no-code technology to streamline processes, enhance efficiency, and improve the overall customer experience. In each case, the adoption of innovative solutions has not only accelerated their digital journeys but has also led to significant cost savings, reduced cycle times, and increased customer loyalty.

- In the healthcare insurance sector, VGM & Associates achieved a five-year digital transformation plan in just three months, independently building eight digital processes, reducing the sales cycle, and saving 30% on operational costs.

- Nürnberger, a German insurance company, swiftly responded to COVID-19 challenges by creating a digital process in six weeks, increasing brand loyalty through flexibility, and embracing agility and adaptability, demonstrating their capacity to accelerate digital transformation, improve efficiency, and enhance customer experiences in the insurance industry.

- Meridio simplified the complex process of onboarding customers across 50 states with varying regulations by transforming 66 PDF packages into a single dynamic digital onboarding process. This streamlined approach eliminated setup and installation time, accelerated customer onboarding nationwide, and improved scalability.

- BTIS, an insurance provider in the construction and small business industries, expedited bond submissions by creating integrated digital processes, resulting in increased form submissions, a better customer experience, and their best binding month to date.

In each of these scenarios, no-code solutions offer insurance companies the flexibility, speed, and efficiency required to adapt to market changes, meet customer expectations, and maintain a competitive edge in a rapidly evolving industry.

The Road Ahead

The integration of no-code solutions in insurance enterprises is not just a trend but a necessary evolution. As insurers navigate an increasingly digital world, the ability to rapidly adapt and innovate will define their success. The adoption of no-code platforms is a strategic move towards building resilience and being well-prepared for the unforeseen challenges of the future.