Auto lending businesses can be highly profitable ventures, but only if they are managed smartly. Companies that want to maximize their profits need to employ strategies that will increase loan volume and decrease risk.

One approach is offering a variety of loan terms and rates to meet customer needs. By giving customers different options when it comes to loan amounts, repayment terms, and interest rates, businesses can better meet customer needs and increase loan volume.

In addition to offering different loan options, businesses should also focus on reducing risk. This includes implementing comprehensive underwriting processes that will help identify potential credit risks before extending a loan.

Strategies for increasing loan volume and minimizing risk in auto lending

Here are some strategies that auto lending businesses can consider to increase loan volume while minimizing risk:

- Conduct thorough credit assessments: Before approving a loan, it's important to conduct a comprehensive credit assessment to evaluate the borrower's creditworthiness. This assessment should consider factors such as credit score, debt-to-income ratio, and employment history.

- Offer competitive interest rates: Offering competitive interest rates can attract more borrowers and increase loan volume. However, it's important to balance this with the need to minimize risk and ensure that the interest rates are appropriate for the borrower's creditworthiness.

- Establish clear loan policies: Establishing clear loan policies can help to minimize risk by ensuring that all loans are underwritten consistently and in compliance with regulatory requirements. This includes defining loan-to-value (LTV) ratios, minimum credit scores, and maximum loan amounts.

- Diversify loan portfolio: Diversifying the loan portfolio by offering loans to borrowers with different credit scores and income levels can help to mitigate risk. This ensures that the business is not overly reliant on a particular segment of borrowers.

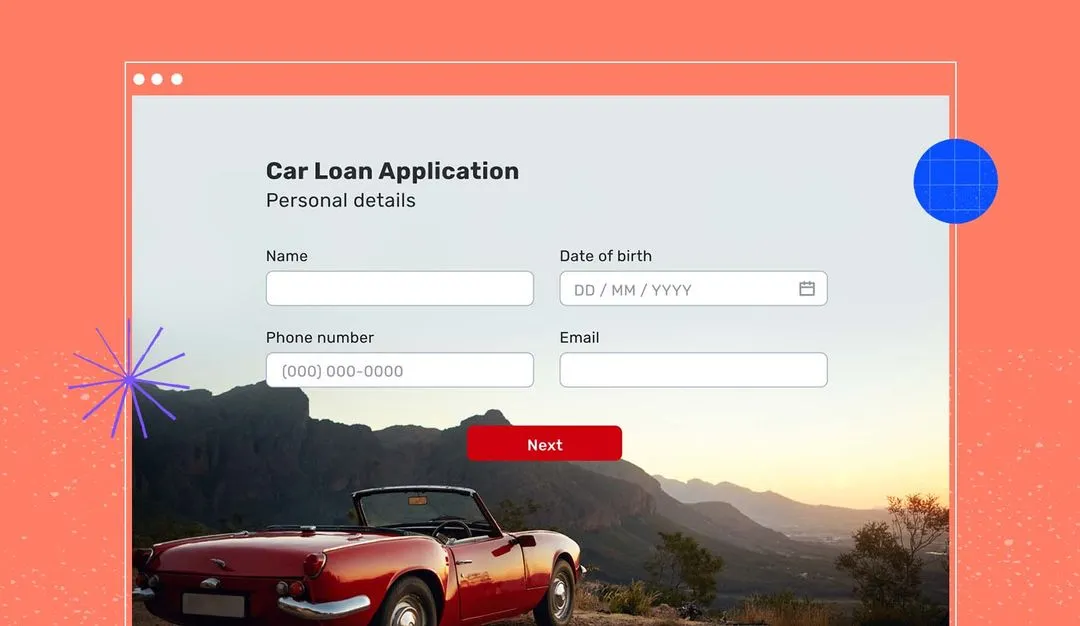

- Leverage technology: Technology can be used to streamline the loan origination process, reduce manual errors, and improve efficiency. This includes implementing automated credit decisioning and online application processes.

- Utilize data analytics: Data analytics can be used to identify trends in borrower behavior, assess credit risk, and optimize pricing strategies. This information can help auto lending businesses to make informed decisions and minimize risk.

- Partner with dealerships: Partnering with dealerships can increase loan volume by providing a direct source of borrowers. However, it's important to establish clear policies and procedures for dealer relationships to ensure that loans are underwritten appropriately and in compliance with regulatory requirements.

- Provide excellent customer service: Providing excellent customer service can help to build loyalty and to increase repeat business. This includes responding promptly to borrower inquiries, providing clear and transparent information, and resolving any issues promptly and professionally.

The key role of reliable and up-to-date customer data in auto lending

For all of the above strategies, it is extremely important that auto lenders have access to the right data in the right format to make informed decisions.

However, auto lenders must collect customer data at various points during the loan origination process:

- Application stage: Auto lenders may manually collect customer data when the borrower completes a loan application. This may include personal information such as name, address, and social security number, as well as information related to employment, income, and credit history.

- Credit assessment stage: During the credit assessment stage, additional information related to credit history, such as payment history, outstanding debt, and credit utilization rates is collected.

- Verification stage: During the verification stage, the accuracy of the information provided by the borrower is verified. This may include contacting the borrower's employer to verify employment and income, or contacting financial institutions to verify bank account information.

- Funding stage: During the funding stage, when the loan is approved and funds are disbursed. This may include collecting additional documentation, such as proof of insurance or vehicle registration.

- Servicing stage: Ongoing communication with the borrower throughout the life of the loan often includes data collection touchpoints. This may include collecting updated contact information, payment information, or information related to changes in the borrower's financial situation.

The issues with manual data collection in auto lending

Often this data is collected manually, either through an online form or by phone. Manual data collection can be a time-consuming and error-prone process for auto lenders. Here are some of the drawbacks of manual data collection:

- Time-consuming: Collecting data manually can be a time-consuming process, especially for lenders who process a high volume of loans. This can lead to delays in loan origination and increased processing times.

- Prone to errors: Manual data collection is more prone to errors than digital data collection methods. Human error can result in incorrect data entry, which can lead to inaccurate loan decisioning and potential financial losses for the lender.

- Difficult to scale: Sincelarger loan portfolios require additional resources and staffing to collect and process data, manual data collection can limit the lender's ability to grow and expand their business.

- Limited data analysis: Manual data collection can limit the lender's ability to perform detailed data analysis. This can make it harder to identify trends and patterns in borrower behavior, assess credit risk, and optimize pricing strategies.

- Compliance risks: Manual data collection can increase the risk of non-compliance with regulatory requirements, as it may be more difficult to ensure that data is collected and processed in compliance with applicable laws and regulations.

- Inefficiencies: Manual processes may require multiple individuals to collect and process data, resulting in duplication of effort and increased costs.

Overall, manual data collection can limit the lender's ability to operate efficiently and effectively while increasing the risk of errors, delays, and compliance issues. Automated data collection methods can help to streamline the loan origination process, reduce errors, and provide lenders with the data they need to make informed decisions.

Digital data intake makes it easier for businesses to get more reliable and timely customer data, which can improve their risk assessment processes, automate credit decisions, and optimize pricing strategies. Having access to a comprehensive view of the customer's financial situation is essential for making informed decisions about loan approval, as well as for minimizing risk.

Digital data intake also provides businesses with an opportunity to leverage advanced analytics and machine learning technologies, which can be used to identify credit risk more accurately.

By leveraging digital data intake processes, auto lenders can streamline the loan origination process and reduce manual errors. This includes using a fully digital platform to securely collect, store, and manage customer data, signatures, and documents throughout the loan lifecycle.