TL;DR

- Loan origination is shifting from static forms and document checklists to dynamic, data-driven journeys.

- Pre-fill eliminates repetitive data entry by pulling verified data from CRMs, core systems, open banking, payroll APIs, and previous applications.

- Smart uploads are moving beyond “attach a PDF” to AI-powered extraction, classification, and fraud checks.

- Real-time validation checks eligibility, completeness, income, identity, and affordability while the borrower is still in the flow, not days later.

- Lenders that adopt end-to-end digital origination and automation are already seeing 35–60% lower processing costs and 25–50% faster decisions.

- The next wave will be powered by AI + open banking + a dedicated digital interaction layer that sits in front of the LOS. That’s where platforms like EasySend come in.

Why loan origination needs a new digital front door

Loan origination has already gone “digital” in many institutions—but much of that digitization is still:

- Static PDFs uploaded through clunky portals

- Re-keyed data between applications, core systems, and risk engines

- Multiple rounds of “please upload this missing document” emails

Fragmented LOS, CRM, and document tools that don’t talk to each other

Meanwhile, borrower expectations have exploded:

- Two in three recent homebuyers say they’re comfortable completing all steps of a mortgage digitally.

- The global loan origination software market is forecast to more than double between 2024 and 2033, driven largely by AI and automation.

- Lenders that embrace origination automation are seeing 35–60% reductions in processing costs and 25–50% faster decision times.

Competitively, “good enough” portals aren’t good enough anymore. The future of loan origination is about removing friction at the source—turning application, document collection, and validation into a seamless, guided, and largely automated experience.

That future is built on three pillars:

- Pre-fill

- Uploads that actually understand documents

- Real-time validation

Pre-fill: from blank forms to “review and confirm”

What is pre-fill in loan origination?

Pre-fill is the ability to auto-populate large parts of a loan application using data the lender already has—or can securely access:

- Existing customer records (CRM, core banking, previous loans)

- Payroll and HR systems

- Open banking & open finance data (transaction histories, account details)

- Public registries and third-party data providers

Instead of asking your customer to type 50 fields, you present a pre-filled journey where they check, correct, and consent.

Why pre-fill matters

- Less friction, higher completion rates – Users abandon long, repetitive forms. Pre-filling reduces “form fatigue” and drop-offs.

- Fewer errors – Manual retyping leads to mismatches and exceptions. Pulling from source systems improves data quality.

- Faster underwriting – Clean, structured data flows straight to decision models and LOS, reducing rework.

Data sources that will power the next generation of pre-fill

- Core and LOS data – For existing customers and renewals, pre-fill can turn a “new” application into a one-click re-application.

- Open banking & open finance – With customer consent, lenders can directly access real-time transaction data instead of asking for PDF bank statements and pay stubs.

- Employer & payroll APIs – Direct connections to payroll systems (where available) reduce the need for manual income documents.

Practical examples

- A returning SME borrower sees 80% of their renewal application pre-filled, only updating revenue and purpose of loan.

- A consumer applying for an auto loan connects their bank and payroll; income, recurring expenses, and basic KYC fields are auto-populated from verified sources.

Uploads: from “attach file” to intelligent document ingestion

The problem with old-school uploads

Most “digital” origination journeys still rely on dumb uploads:

- “Attach your last 3 pay slips.”

- “Upload bank statements for the last 6 months.”

- “Upload ID, proof of address, and business registration.”

Behind the scenes, teams manually:

- Download and view documents

- Re-enter numbers into systems

- Check for completeness and consistency

- Flag anomalies by hand

It’s slow, error-prone, and impossible to scale.

Smart uploads & AI-powered document handling

The future of uploads in loan origination is not just accepting files—it’s understanding them:

- Document classification – Automatically recognize document type (ID, pay slip, bank statement, tax return, corporate registration).

- Data extraction – Use AI/OCR to pull structured data (income, employer, balances, liabilities, addresses) into your decisioning engine.

- Quality & fraud checks – Spot tampering, missing pages, non-matching names, or inconsistent figures.

- Instant feedback – Surface issues while the borrower is still online: “This pay slip is missing page 2; please upload again.”

Why uploads are becoming a first-class interaction, not an afterthought

- Borrowers get clarity – They know exactly which documents are needed, which are accepted, and what’s still missing—in real time.

- Operations gets scale – Document intake becomes a semi- or fully-automated pipeline, not a manual queue.

- Risk teams get better data – Clean, structured document data feeds your risk models, helping refine pricing and approval strategies.

Real-time validation: decisions driven by live data, not static snapshots

What is real-time validation in loan origination?

Real-time validation means validating data as it’s entered or captured, not days later. This includes:

- Form-level validation – Required fields, formats, ranges, cross-field checks (e.g., loan amount vs declared income).

- Data source validation – Verifying identities, income, assets, and liabilities against trusted data sources (open banking, credit bureaus, payroll APIs).

- Eligibility checks – Running rules and models mid-journey to indicate whether the applicant is on track to meet criteria.

Why real-time matters

- Reduces back-and-forth – If income is too low, a document is missing, or a field is inconsistent, you can catch it immediately and suggest alternatives.

- Improves CX and transparency – Borrowers see clear, contextual messages instead of a rejection email 7 days later.

Enables instant or near-instant decisions – Lenders using automation and real-time data report far faster turnaround times and higher customer satisfaction.

What real-time validation will look like in practice

- The borrower connects their bank account; a real-time affordability check runs in the background. If affordability is borderline, the UI surfaces options (lower amount, longer term, co-borrower).

- As documents are uploaded, system checks completeness and coherence (e.g., income on the pay slip vs bank transactions vs declared income).

- For repeat borrowers, the system immediately suggests the best product and amount based on up-to-date behavior and risk models.

The architecture behind the future: LOS, data, and a digital interaction layer

Most lenders already have:

- A LOS for origination and underwriting

- A core banking system for accounts and servicing

- A CRM or customer data platform

- Document repositories, RPA, and analytic tools

What’s missing is often a dedicated digital interaction layer—the orchestrator that:

- Connects to LOS/CRM/core and external data sources

- Powers pre-fill, uploads, and validation in real time

Manages multi-party journeys (borrower, co-borrower, guarantor, broker, internal approver) - Gives business teams control to change the workflow without writing code

That’s the gap platforms like EasySend are designed to fill.

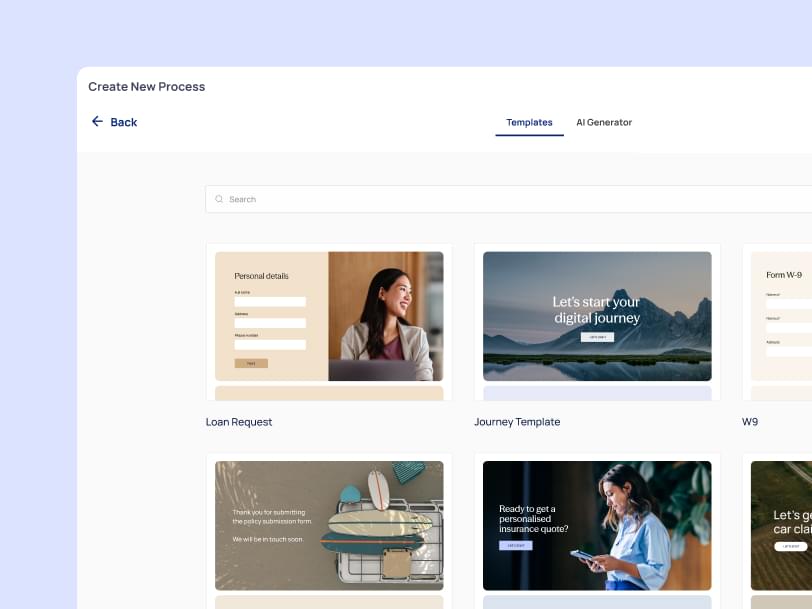

Where EasySend fits into the future of loan origination

EasySend is a digital customer interaction engine that acts as the front-door layer for loan origination, sitting above existing LOS and core systems.

How EasySend supports “pre-fill, uploads, and real-time validation”

- Pre-fill from core systems & CRMs

- Pull customer and product data from Salesforce, core banking, LOS, and other systems.

- Use that data to pre-populate applications for renewals, cross-sell, or repeat borrowers.

- Smart uploads with structured data capture

- Guide borrowers to upload exactly what’s needed, step by step.

- Tag, validate, and route documents inside the journey so nothing gets lost in email threads.

- Real-time validation inside the journey

- Apply complex eligibility and business rules as the user fills in data.

- Trigger warnings, hints, or alternative paths when conditions aren’t met.

Support multi-party flows—borrower, co-borrower, guarantor, back-office reviewer—inside one orchestrated experience.

- No-code / low-code for business teams

- Non-technical teams can update content, rules, and flows without waiting for IT or vendors.

- That agility is crucial as underwriting policies and regulatory requirements change.

Why this matters strategically

- You don’t need to rip and replace your LOS.

- You can keep your risk models, data warehouse, and integrations—and simply upgrade the borrower and operations experience.

- You can move from “forms + email + portal” to end-to-end digital journeys tailored by product, segment, and partner.

How to get started: a practical roadmap for lenders

If you’re planning the next generation of your origination experience, a pragmatic approach might look like:

- Identify your highest-friction journeys

- e.g., SME working capital, auto loans, mortgage renewals, personal credit lines.

- e.g., SME working capital, auto loans, mortgage renewals, personal credit lines.

- Map data sources for pre-fill

- CRM, core, LOS, open banking, payroll, bureau.

- CRM, core, LOS, open banking, payroll, bureau.

- Define your document matrix

- For each product and segment: which documents, from whom, at which step, and in which format.

- For each product and segment: which documents, from whom, at which step, and in which format.

- Translate policies into validation rules

- Turn your credit and compliance policies into machine-readable rules that can run in real time.

- Turn your credit and compliance policies into machine-readable rules that can run in real time.

- Introduce a digital interaction layer

- Use a platform like EasySend to orchestrate pre-fill, uploads, and validation on top of your existing stack.

- Use a platform like EasySend to orchestrate pre-fill, uploads, and validation on top of your existing stack.

- Pilot, measure, and iterate

- Track drop-off rates, time to decision, NPS, and manual effort.

- Roll out to more products and segments once you’ve proven ROI.