KYC and AML compliance have always been cornerstones of financial services, but the way firms collect and manage that data is changing fast.

As customer expectations shift toward real-time, mobile-first interactions, outdated methods like paper forms, static PDFs, and back-and-forth emails are no longer sustainable. At the same time, increasing regulatory pressure and growing customer acquisition costs are forcing banks, fintechs, and wealth managers to rethink the entire onboarding experience.

The answer? Dynamic, digital-first forms that adapt in real time, reduce friction, and ensure compliance without slowing things down.

Why static forms no longer work for KYC and AML

Most financial institutions still rely on some combination of PDFs, spreadsheets, and rigid online forms to collect critical onboarding data. But this creates major challenges:

- Operational inefficiency: Manual reviews, duplicate requests, and copy-pasting between systems waste time and increase costs.

- Poor customer experience: Customers are asked for the same information multiple times. They often drop off when they can’t complete forms on mobile or don’t know what’s missing

- Compliance risk: Missing fields, incorrect uploads, and lack of proper audit trails can result in fines or delayed approvals.

- Lack of visibility: Internal teams struggle to track where each application stands, what’s pending, and who needs to act next.

These issues become even more complex in workflows involving multiple stakeholders, cross-border requirements, or high-risk profiles.

What makes a form “dynamic”?

A dynamic form isn’t just digital, t’s intelligent. It adapts based on the user, the data already known, and the regulatory context.

Dynamic forms built with EasySend allow you to:

- Prefill known customer data from your CRM or core systems

- Show or hide fields based on customer type, region, or risk level

- Validate inputs in real time (e.g., ID formats, required uploads)

- Collect digital signatures and route forms through approval steps

- Update multiple systems with structured, compliant data

The result is a smarter, smoother experience for both customers and internal teams, while meeting all compliance requirements.

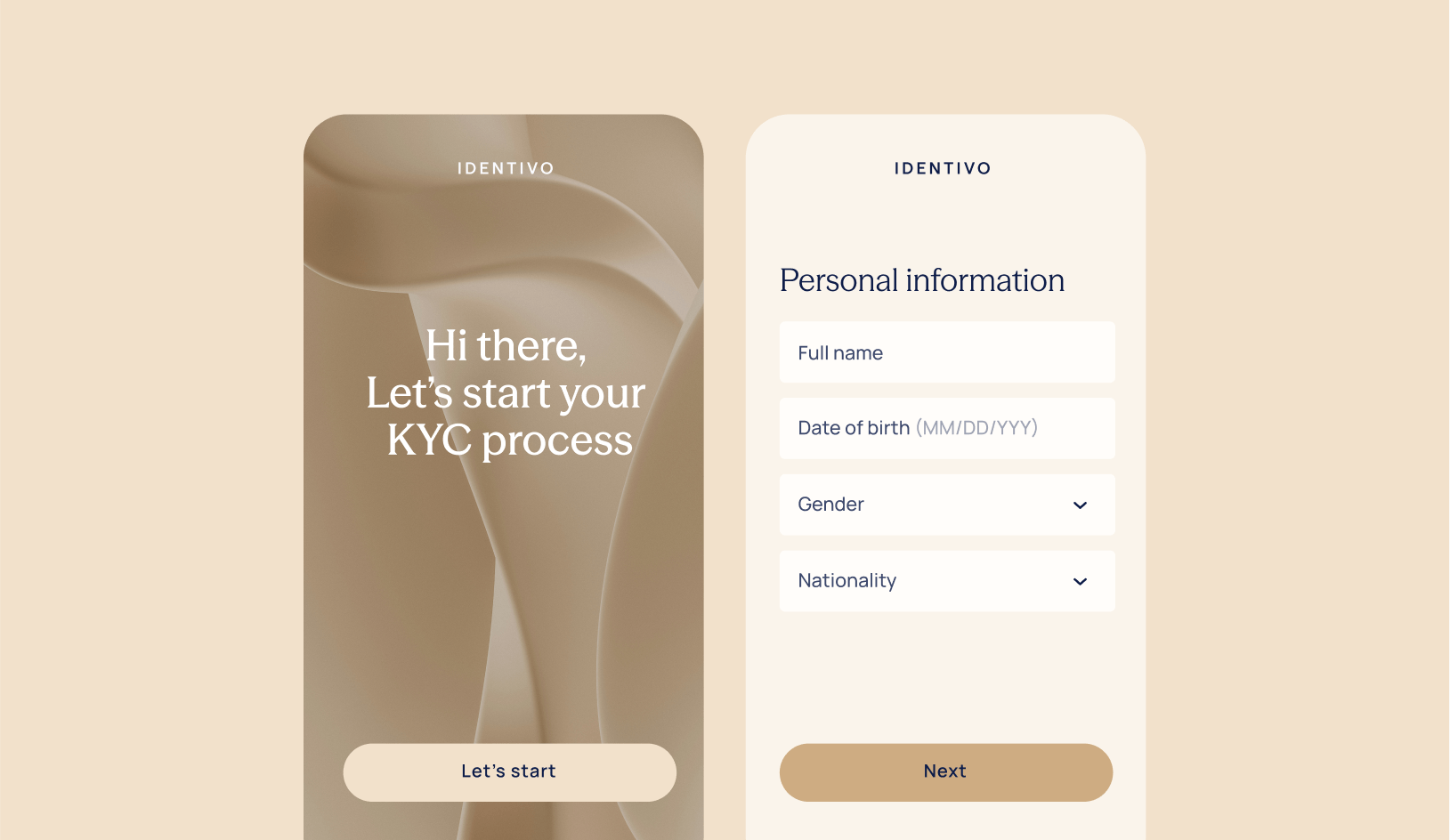

KYC: Onboarding the right way, the first time

Know Your Customer (KYC) workflows require identity verification, document collection, and risk profiling, often across several systems.

Challenges:

- Multiple parties (customer, advisor, compliance officer)

- Varying requirements by country or account type

- Repeated touchpoints due to errors or missing data

Dynamic form solution:

With EasySend, teams can create a single adaptive journey that adjusts in real time. For example, corporate clients can be shown different fields than individuals. High-risk geographies can trigger extra steps. Fields can be auto-filled from Salesforce or another CRM.

Outcomes:

- Faster onboarding

- Lower abandonment rates

- Complete, validated KYC packages

- Fewer compliance flags downstream

AML: Going beyond form collection

Anti-Money Laundering (AML) compliance isn’t just about collecting documents, it’s about gathering the right data and proving due diligence.

Challenges:

- Additional scrutiny for high-risk clients

- Ongoing monitoring and document refresh cycles

- Reconciliation across internal systems

Dynamic form solution:

Dynamic forms help AML teams create conditional flows that only ask for what's required, no more, no less. For example, a politically exposed person (PEP) can be routed into enhanced due diligence automatically. Fields can be tagged for review, flagged, or sent for approval, all within a unified digital process.

Outcomes:

- Streamlined enhanced due diligence

- Faster AML review cycles

- Better auditability

- Reduced operational burden on compliance teams

Beyond compliance: Use cases for dynamic forms in financial services

Once you digitize KYC and AML, you can use the same building blocks to streamline dozens of other workflows. EasySend customers are using dynamic forms to digitize:

- Investor onboarding for hedge funds and wealth firms

- Loan applications with ID and income verification

- Account updates for retail and business clients

- Regulatory disclosures requiring eSignatures

- Dispute resolution with multi-party collaboration

All of these use cases share the same DNA: multiple steps, data validation, compliance requirements, and customer-facing friction. With a dynamic form engine, you can solve them all using one platform, without dev resources.

Why EasySend?

EasySend isn’t just a form builder, it’s a dynamic interaction engine built specifically for regulated industries. Our low-code platform helps banks, fintechs, and insurers digitize complex workflows across onboarding, servicing, and compliance.

EasySend supports:

- Multi-step forms with real-time logic and validation

- Role-based workflows (e.g., employee, advisor, compliance officer)

- eSignatures, document uploads, and field-level permissions

- Parallel, serial, and real-time “sign together” signing modes

- Native integrations with Salesforce and core banking platforms

Final thoughts: From forms to workflows

In today’s regulatory and customer environment, static forms aren’t just outdated, they’re a liability.

Dynamic forms enable financial institutions to:

- Automate onboarding and compliance

- Reduce operational costs

- Improve customer experience

- Ensure data quality and audit readiness

Whether you’re launching a new product, scaling onboarding, or tightening compliance, EasySend helps you get there faster, without sacrificing control.