TL;DR

Borrowers abandon loan applications when forms are long, unclear, or disconnected. Replace PDFs and portals with AI-powered digital journeys that guide each step, validate in real time, and keep every participant in sync, boosting completion rates and borrower trust.

Every lender knows the feeling: a promising applicant starts a loan application, uploads a document or two… and disappears.

Borrower abandonment is one of the most persistent (and costly) problems in lending. Whether you’re originating consumer loans, mortgages, or small business financing, every half-finished form represents lost revenue, wasted acquisition spend, and declining borrower trust.

But the issue isn’t that borrowers are impatient, it’s that the process they’re given doesn’t match the way they live and work today.

In this post, we’ll unpack why borrowers quit mid-application and how AI-powered digital journeys can reverse that trend by making the experience faster, clearer, and fully guided from start to finish.

The real reasons borrowers drop off

- Too many steps, too little guidance: Traditional applications dump every possible field onto a single page. Borrowers don’t know which sections apply to them, what’s required, or what can wait. The result? Confusion, frustration, and drop-offs.

- Manual document collection: When lenders rely on emails and attachments for pay stubs, IDs, or tax returns, delays are inevitable. Missing files lead to multiple follow-ups, which borrowers perceive as disorganization, not diligence.

- Lack of real-time validation: Most forms still allow borrowers to submit incomplete or incorrect information. When errors surface days later, it means another round of calls or messages to fix them.

- No mobile-first experience: Borrowers expect to apply on their phone during a lunch break. Static PDFs and desktop-only portals are deal-breakers. If a form isn’t mobile-optimized, they’ll abandon it.

- No transparency or feedback: People abandon processes they don’t understand. If borrowers can’t see progress, next steps, or confirmation that their documents arrived safely, they lose confidence and move on.

- Multi-party friction: Co-borrowers, guarantors, and advisors often enter the process through separate emails and inconsistent experiences. Without synchronized workflows, someone always gets left behind.

The hidden cost of abandonment

Each incomplete application drains resources, from marketing to underwriting. Studies show that financial institutions can lose up to 40–60% of potential borrowers between “start” and “submit.”

But the damage extends beyond lost deals. High abandonment signals weak digital trust, poor communication, and processes that feel outdated. In competitive lending markets, that perception can push borrowers straight to your faster-moving rivals.

How digital journeys solve borrower drop-off

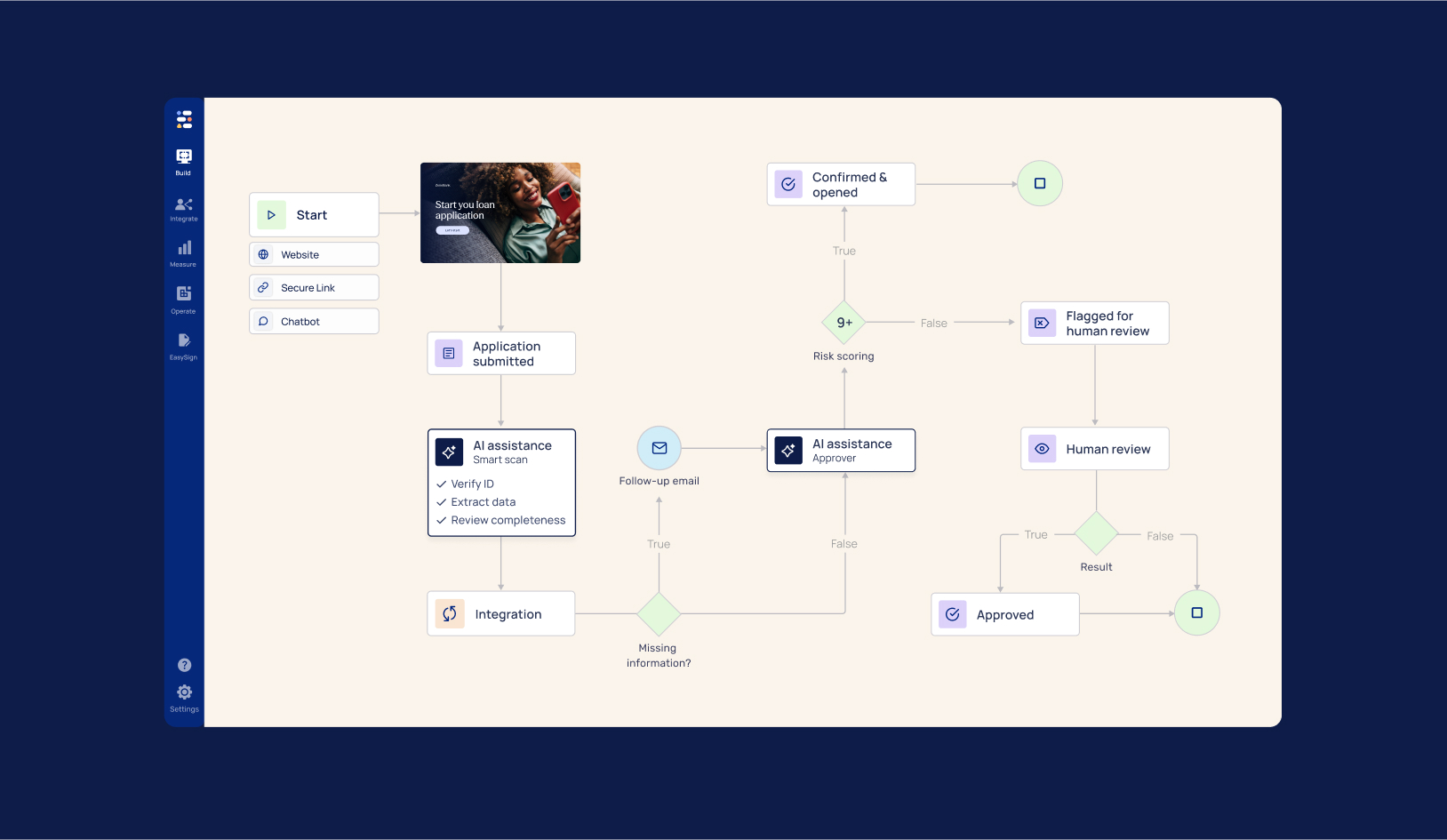

Digital journeys, like those built on EasySend’s AI-powered platform, reimagine loan applications as dynamic, guided experiences that adapt to each borrower’s context in real time.

Here’s how they turn friction into flow:

1. Guided, step-by-step structure

Instead of showing 60 fields at once, journeys guide borrowers through short, focused screens. Conditional logic hides irrelevant questions (e.g., self-employed vs. salaried), keeping the experience simple and human.

2. Real-time validations and feedback

Borrowers get instant confirmation when data is valid or complete, and gentle prompts when something’s missing. No guessing, no “please resend” emails later.

3. Smart document collection

AI-driven checklists automatically request only the documents relevant to the borrower’s profile and loan type. Upload validations ensure every file is the right type, size, and age before submission.

4. Mobile-first, omnichannel access

Journeys work across devices and channels, web, SMS, or email link, with save-and-resume built in. Borrowers can start on one device and finish on another without losing progress.

5. Multi-party collaboration

Co-borrowers, guarantors, and internal approvers all share the same digital flow. EasySend supports parallel, serial, and sign together signing modes, eliminating delays between participants.

6. Transparency and trust

Every journey includes a progress tracker, confirmation screens, and automated notifications. Borrowers always know what’s next, and that builds confidence.

Inside a “borrower-first” application journey

Here’s what a modern AI-assisted loan journey looks like:

- Start: Borrower enters via personalized link from Salesforce or email.

- Prefill: Known data (name, contact, loan type) appears automatically.

- Dynamic branching: Journey adapts, mortgage, auto, or business loan, showing only relevant fields.

- Document intake: Borrower uploads pay stubs, ID, or tax returns with real-time checks.

- Co-borrower invite: Automated parallel flow triggers.

- eSignature: Borrowers sign electronically; compliance receives an audit trail instantly.

- Sync: Data and files map back to Salesforce or LOS automatically.

- Confirmation: Borrower sees a success screen and receives an email with next steps.

The experience feels more like a guided app than a form, intuitive, responsive, and friction-free.

The measurable impact

Lenders that transition from static forms to digital journeys report dramatic improvements:

- +40% higher completion rates

- 70% faster loan onboarding

- 0 manual email follow-ups for missing docs

- Higher borrower satisfaction scores and repeat business

The bigger picture

In short: journeys don’t just collect data, they build relationships.

Borrowers don’t abandon applications because they don’t want loans. They abandon because the process feels disconnected, uncertain, or outdated. AI-powered journeys bridge that gap. By turning every step, from data entry to document upload to signing, into a guided, real-time interaction, lenders remove friction while reinforcing trust.

That’s how you move from a drop-off problem to a conversion advantage.

.jpg)