Importance of Customer Data Intake in Insurance

Customer data intake is the process of gathering and recording information from customers to understand their risk profile and determine appropriate insurance products. This data serves as the foundation for every decision made by an insurance company, from calculating premiums to settling claims. Here are some reasons why customer data intake is crucial in insurance:

- Risk Assessment: Insurance is all about managing risk. By collecting customer data, insurance companies can evaluate the level of risk associated with insuring a particular individual or entity. This helps in setting premiums that accurately reflect the potential risks and ensures fair treatment for all customers.

- Policy Issuance: The data collected during the intake process provides insurers with the necessary information to determine which insurance products are suitable for a particular customer. For instance, a customer's health data may help an insurer offer a more comprehensive health insurance policy.

- Claims Management: In case of an accident or loss, accurate and complete data is essential for processing claims efficiently. Customer data helps insurers verify the authenticity and severity of a claim, enabling them to provide timely and fair compensation to their customers.

- Underwriting Decisions: Underwriting is the process of evaluating and accepting or rejecting risks for insurance policies. Customer data plays a crucial role in this process as it helps insurers determine if an applicant meets their risk criteria and under what terms they are willing to insure them.

- Product Development: Customer data intake also provides valuable insights into customer behavior, preferences and needs. This information can be used to develop new insurance products or customize existing ones according to customer demands.

- Fraud Detection: Insurance fraud is a significant concern for insurance companies, and accurate data collection can help identify suspicious claims. With the right data, insurers can flag potentially fraudulent activities and conduct further investigations.

The importance of customer data in the insurance industry cannot be overstated, as it lies at the heart of several crucial operations.

- Risk assessment and underwriting depend heavily on accurate customer data. By analyzing data points from policy information to claims history, insurers can accurately assess the risk associated with insuring an individual or business, thus setting premiums accordingly.

- This data allows for the creation of personalized product offerings. Insurers can tailor their products and services to meet the unique needs of each customer, enhancing customer satisfaction and loyalty.

- Regulatory compliance mandates the proper management and protection of customer data. Insurers must adhere to stringent regulations regarding data privacy and protection, ensuring that customer information is securely stored and used in compliance with the law. Failure to do so can result in severe penalties, making the diligent handling of customer data not just a business imperative but also a legal requirement.

Chapter 1: Understanding Customer Data in Insurance

Types of Customer Data in Insurance

In the realm of insurance, harnessing the right types of customer data is pivotal for delivering exceptional services and tailoring policies to individual needs. The core categories of customer data collected by insurers include:

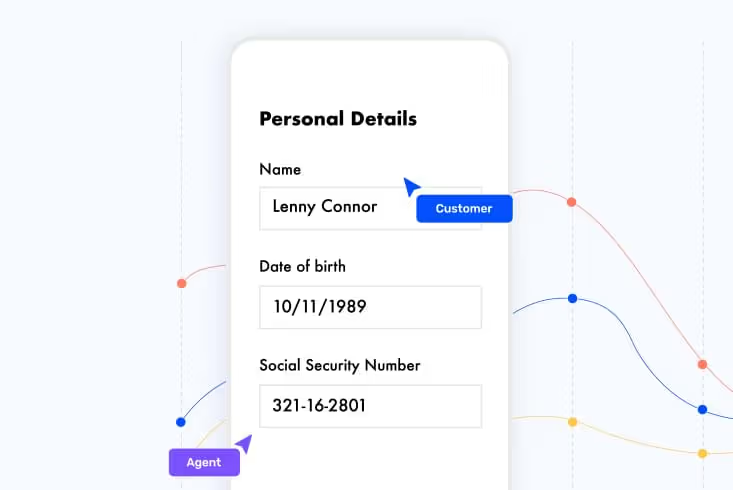

- Personal Information: Includes contact details such as names, addresses, phone numbers, and email addresses, as well as financial information like income, assets, debts, and credit scores. Medical information such as health history and pre-existing conditions is also essential.

- Demographic Information: Includes age, gender, marital status, education level, occupation, and household demographics. This information helps insurers segment their customers and understand which groups are more likely to require certain types of insurance coverage.

- Risk Information: Includes data related to the risk insured against, such as property value for homeowners' insurance or driving history for auto insurance. This data helps determine the likelihood of a claim being made and the premium to be charged.

- Behavioral Information: Includes data on customer behavior, such as past insurance claims, policy renewal history, and communication preferences. This information helps insurers understand their customers' needs better and provide targeted recommendations.

- Policy Information: Details of a customer's policy, including coverage type, effective and expiration dates, are vital for servicing policies and managing renewals.

- Claims History: Records of all claims made by customers, including claim dates, types, and outcomes, are crucial for underwriting and risk management purposes.

- Payment History: A record of all payments made by customers, including payment dates, amounts, and methods, is important for customer service and accounts receivable.

- Interaction History: Records of all interactions customers have had with the company, such as phone calls, emails, live chats, and social media messages, are valuable for customer service and marketing.

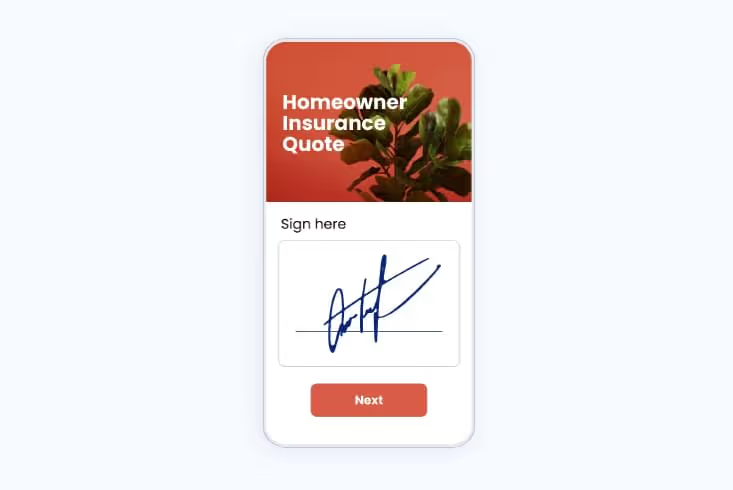

- Signatures: Both physical and digital signatures are important for legal and compliance purposes, with digital signatures becoming increasingly common for ease of collection and storage.

- Agent Information: Details of the agent who sold the policy to the customer, including name and contact information, are necessary for proper compensation and accountability.

Data Intake and Management Infrastructure

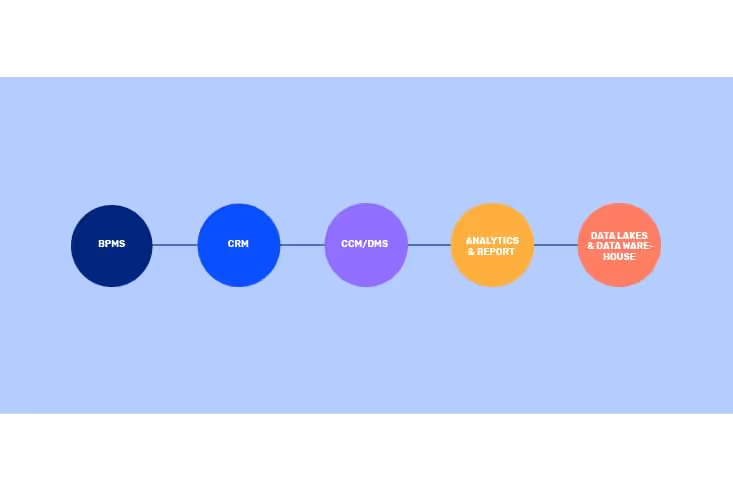

To effectively handle and derive insights from the vast array of data types mentioned, insurers require a sophisticated Data Intake and Management Infrastructure. This infrastructure often involves the integration of several systems designed for specific functions:

- Business Process Management System (BPMS): A BPMS enables insurers to streamline and automate the workflows associated with data collection, policy issuance, claims processing, and other core insurance processes. It helps in reducing manual errors and improving operational efficiency.

- Customer Relationship Management (CRM): CRM systems are crucial for managing all aspects of an insurer's interactions with current and potential customers. From tracking policyholder information and interaction history to facilitating targeted marketing campaigns and personalized service, CRM tools play a pivotal role in enhancing customer satisfaction and loyalty.

- Customer Communication Management (CCM)/Document Management Systems (DMS): These systems are vital for managing the large volumes of documents and communications generated in the insurance industry. CCM and DMS solutions help insurers in organizing, storing, and retrieving documents efficiently while ensuring compliance with regulatory requirements. They also enable effective communication with policyholders through various channels, ensuring that customers are informed and engaged.

- Analytics and Reporting Tools: Insurers require robust analytics and reporting tools to gain actionable insights from the vast amounts of data at their disposal. These tools help insurers in identifying trends, patterns, and anomalies in their data, which can guide critical decision-making processes.

- Data Warehousing and Data Lakes: To store, integrate, and manage large volumes of structured and unstructured data, insurers rely on data warehousing and data lake solutions. These systems enable insurance companies to harness the power of big data and leverage advanced analytics techniques for better risk assessment, fraud detection, and customer segmentation.

Chapter 2: The Evolution of Customer Data Intake

Historical Overview

The insurance industry's approach to customer data intake has witnessed a significant transformation over the years. Traditionally, the process was labor-intensive, relying heavily on paper-based forms, in-person meetings, and manual data entry. This not only made the process time-consuming but also prone to errors and inconsistencies. The reliance on physical documents for application forms, claims submissions, and communication with policyholders often resulted in delays and a less-than-ideal customer experience.

Traditional methods of data collection

Initially, customer data collection methods in the insurance sector were predominantly manual. Agents would collect information directly from clients through face-to-face interactions or over the phone, filling out forms that would later need to be manually entered into a database. This process was not only slow but also inefficient, with a high potential for data entry errors and loss of information.

The shift to digital intake processes

The advent of technology introduced a pivotal shift towards digital intake processes. Online applications, email communications, and digital document submissions began replacing traditional paper-based methods. This transition allowed for faster data collection, improved accuracy, and a more streamlined workflow. Digital platforms enabled insurers to process applications, claims, and policy changes with greater efficiency, propelling the industry into a new era of operational excellence.

The shift to customer interaction layer

With further advancements in technology, the insurance industry is now witnessing a shift towards a more interactive and customer-centric data intake process. This shift not only enhances the customer experience by providing convenience and immediacy but also frees up valuable resources within insurance companies, allowing them to focus on more strategic tasks. The introduction of these digital interfaces has paved the way for a more dynamic and responsive interaction layer between insurers and policyholders, marking a new chapter in the industry's evolution.

What is the customer interaction layer?

The Customer Interaction Layer is a specialized platform designed to centralize and optimize customer interactions across various channels. It employs advanced technologies to provide dynamic, personalized, and responsive communications, addressing the evolving needs of modern businesses and customers. Key features include adaptive real-time interactions, unified platform integration, comprehensive compatibility with existing systems, channel-agnostic communication, and a customer-centric design.

Unifying Multiple Channels

Today, customers interact with businesses through various channels such as mobile apps, websites, social media platforms, chatbots, and more. The customer interaction layer integrates all these channels to provide a seamless and consistent experience for policyholders across their entire journey. This integration enables insurers to gather data from multiple sources in real-time, leading to a deeper understanding of customer needs and behaviors.

- Digital Platforms and Portals

- Online forms and e-signatures

- Mobile apps for data submission

- IVR

- Chatbots for self-service

- Social media platforms for communication and feedback

Treating these as siloed and discreet channels often results in disjointed and inconsistent customer experiences. By centralizing and optimizing these interactions, the customer interaction layer makes it easier for insurers to deliver personalized and timely communications that cater to individual preferences.

Real-Time Interactions

The customer interaction layer is equipped with advanced technologies such as AI, machine learning, and analytics to enable real-time interactions. This allows insurers to respond quickly and accurately to customer needs and concerns. By leveraging data from various sources, the platform can provide personalized recommendations and offers.

Chapter 3: Best Practices for Data Intake

Transitioning from multiple point solutions to a single unified intake system is crucial for insurance companies to stay competitive in today's market. Here are some best practices that insurers should consider when implementing a new data intake process.

1. Define your objectives

Before implementing any changes, insurers need to identify their goals and objectives for the data intake process. This includes evaluating pain points in the current system, determining key metrics for success, and understanding how the new process will improve overall operations.

2. Choose a scalable and flexible technology

With constantly evolving technology, it is important to choose a data intake solution that can adapt and scale with future changes. This will help insurers avoid costly replacements or updates in the long run.

3. Train your team

Introducing a new data intake process means that employees will need to be trained on the new system. It is crucial to provide comprehensive training and support for all staff members to ensure a smooth transition and efficient usage of the new technology.

4. Automate where possible

Automating processes can significantly reduce manual labor and save time for both insurers and their customers. This includes automating data entry, data validation, and other routine tasks. Not only does this improve efficiency, but it also minimizes the risk of human error.

5. Utilize analytics

Data is a crucial asset in the insurance industry, and implementing a new intake process presents an opportunity to collect and analyze more data. Insurers should take advantage of this by utilizing analytics tools to gain insights and make data-driven decisions.

6. Prioritize security and privacy

With the increasing threat of cyber attacks, it is essential for insurers to prioritize security and privacy in their data intake process. This includes implementing secure data transfer protocols, regularly updating software and systems, and educating employees on best practices for protecting sensitive information.

7. Regularly review and update

The technology landscape is constantly changing, and so should an insurer's data intake process. It is important to regularly review and update the process to ensure it remains efficient, secure, and compliant with any new regulations or standards.

8. Consult with experts

Implementing a new data intake process can be daunting, and it may be beneficial for insurers to seek guidance from experts in the field. This could include technology consultants, data security specialists, or industry professionals who have experience with similar processes.

9. Communicate changes effectively

Effective communication is crucial when implementing a new data intake process. Insurers should clearly communicate any changes and updates to their staff and customers to ensure a smooth transition and avoid any confusion or disruptions in service.

10. Continuously monitor and improve

Finally, it is important for insurers to continuously monitor and improve their data intake process. This could involve gathering feedback from employees and customers, conducting regular audits, and staying informed about industry best practices and advancements in technology. By consistently striving for improvement, insurers can ensure that their data intake process remains efficient, secure, and compliant.

11.Use Purpose-Built Solutions

Insurance companies require a purpose-built tool for customer interactions for several compelling reasons.

- Firstly, it enables a seamless and efficient communication channel that meets the modern policyholder's expectations for immediacy and convenience. In an age where digital services are the norm, this layer helps insurers deliver an experience that aligns with the customer's lifestyle and preferences, encouraging engagement and satisfaction.

- Secondly, it provides insurers with valuable insights into customer behaviors and needs through data analytics, allowing for personalized services and products. This personalization not only enhances customer satisfaction but also boosts loyalty and retention.

- Lastly, by automating routine interactions, it allows insurance professionals to dedicate more time and resources to complex cases and strategic initiatives, thereby improving overall operational efficiency and service quality.

Chapter 4: How to Select Customer Intake Tool?

When selecting a customer intake tool, insurance companies should consider the following factors:

- Integration capabilities: The tool should easily integrate with existing systems and processes to avoid disruption and ensure smooth operations.

- Customizability: It should allow for customization based on specific business needs, such as capturing relevant data points or incorporating branding elements.

- Scalability: As the company grows, the tool should be able to accommodate an increasing volume of interactions without compromising performance.

- Security: The tool must comply with industry security standards and regulations to protect sensitive customer information.

- Analytics capabilities: In addition to collecting data, the tool should provide analytics capabilities that enable insurers to gain valuable insights into customer behavior and needs.

- User-friendliness: A user-friendly tool with a simple and intuitive interface will make it easier for insurance professionals to use and maximize its benefits.

- Cost-effective: The tool should provide value for money by streamlining processes, reducing costs, and increasing revenue in the long run.

- Customer feedback and reviews: Consider the experiences of other insurance companies who have used the tool to understand its effectiveness and potential drawbacks.

It is important to carefully evaluate these factors and prioritize the ones that align with the company's goals and objectives. Additionally, involving key stakeholders in the decision-making process can help identify any unique requirements or concerns and ensure a successful implementation of the customer intake tool.

Chapter 5: Must-Have Features of Customer Data Intake Tools

Customer data intake tools should have certain must-have features that ensure their effectiveness in streamlining processes, improving customer experience, and ultimately driving business growth. Some of these essential features include:

Adaptive Real-Time Interactions

The platform dynamically adjusts to customer inputs in real-time, ensuring that interactions are always relevant, personalized, and efficient. This adaptability enhances the customer's experience by making communications more intuitive and engaging.

Unified Platform for All Interactions

Unlike traditional systems that may rely on multiple, disconnected solutions for different aspects of customer engagement, this engine provides a single, integrated platform for all customer interactions. This unification simplifies the management of customer communications and ensures consistency across all channels.

Comprehensive Integration

Fully compatible with business process management systems (BPMS), customer communication management (CCM), and other middleware, the platform ensures that customer interactions are not only dynamic but also deeply integrated with a company's core operations and workflows.

Channel-Agnostic Communication

The engine supports communication across any channel, making it versatile and accessible for customers regardless of their preferred method of interaction. This feature is particularly important in today's multi-channel communication environment.

Customer-Centric Design

At its heart, the platform focuses on delivering a customer-centric user interface (UI), which prioritizes ease of use, accessibility, and satisfaction in every interaction.

Integration Capabilities

In addition to integrating with existing business processes and systems, the platform also offers robust integration capabilities with external data sources. This allows for personalized and contextualized communication based on customer data, resulting in a more meaningful and effective engagement.

Scalability and Flexibility

This platform is designed to scale with a company's growth, accommodating large volumes of interactions while maintaining high levels of performance. It also offers flexibility in terms of customization, allowing businesses to tailor the platform to meet their specific needs and requirements.

Analytics and Insights

The platform provides extensive analytics capabilities, delivering valuable insights into customer behavior, preferences, and trends. This information can then be used to further enhance customer engagement strategies and drive positive business outcomes.

Chapter 6: Overcoming Challenges in Customer Data Intake

Data Accuracy and Validation

Ensuring data quality begins with implementing robust techniques for data validation and cleansing. This involves setting up comprehensive checks to verify the accuracy and completeness of the data as it enters the system. Utilizing algorithms that identify and rectify inconsistencies, duplicate entries, and other common errors can significantly improve the reliability of customer information.

Additionally, adopting a standardized format for data entries helps in minimizing discrepancies and facilitating easier data management and analysis. Regular audits of the data also play a crucial role in maintaining its integrity over time, allowing businesses to make informed decisions based on accurate and up-to-date information.

This proactive approach to data management ensures that customer data intake is both effective and efficient, paving the way for successful engagement strategies.

Integration with Existing Systems

Incompatibility issues, data migration complexities, and security concerns are some of the common roadblocks that may arise during this process. To overcome these challenges, it is essential to conduct thorough research and choose a platform that offers seamless integration capabilities.

Moreover, working closely with IT teams and leveraging APIs can help bridge any data integration gaps between systems. Regular testing and monitoring of the integration process are also crucial to identify and resolve any issues in a timely manner.

Data Privacy and Security

Data privacy has become a significant concern for customers, given the increasing number of data breaches reported in recent years. Businesses must prioritize securing customer data by implementing robust security measures throughout the data management process.

This includes implementing access controls, encryption, and regular backups to prevent unauthorized access and safeguard against data loss. Compliance with relevant data privacy regulations is also essential in maintaining customer trust and avoiding potential legal consequences.

Chapter 7: The Future of Customer Data Intake in Insurance

The Customer Interaction Layer is indispensable in modernizing the insurance sector's approach to data intake. This layer serves as the frontline interface between the insurance provider and the customer, offering a streamlined and user-friendly experience for data submission and consultation.

By unifying all customer-facing channels such as AI-driven chatbots, mobile applications, and interactive web portals, insurers can facilitate a more engaging and efficient communication channel. These advancements not only enhance the customer experience by making data submission more intuitive and less time-consuming but also enable the insurer to gather data more accurately and securely.

Implementing a robust Customer Interaction Layer is paramount for insurance companies aiming to stay competitive in a digital age where customer expectations are continually evolving.

Key Takeaways

- The Customer Interaction Layer plays a crucial role in modernizing the insurance sector's approach to data intake.

- By unifying all customer-facing channels, insurers can enhance the customer experience and gather data more accurately and securely.

- Implementing a robust Customer Interaction Layer is essential for insurance companies to stay competitive in the digital age.

.avif)

.avif)

.avif)

.avif)