Are you ready for the shift to digital First Notice of Loss? You've likely heard of the digital revolution and its impact across all industries.

For insurers, there's a direct correlation between customer experience and revenue generation. Claims experience is no exception and is rapidly becoming a key factor in insurance purchasing decisions. Customers expect more than just quick and easy claims processing: they want an experience that's convenient, transparent and digital-first.

[.figure]70%[.figure]

[.emph]of consumers will switch insurers within 5 years if their current insurer isn't delivering on their expectations.[.emph]

And insurers need to deliver on this expectation: according to McKinsey, 70% of consumers will switch insurers within 5 years if their current insurer isn't delivering on their expectations. According to recent data from J.D. Power, 77% of auto insurance customers say they are either actively shopping for a new carrier or have experienced an adverse event that triggered shopping activity.

Digital First Notices of Loss (FNOL) is the first step in this journey to digital claims experience.

If your business is not transitioning to electronic FNOL, put it at the top of your priority list. A recent Willis Towers Watson report revealed that digitally enabled claims experiences can drive up to a 20% increase in retention and acquisition.

Reimagining FNOL process as a digital journey

Digital journeys are complex, but if you are considering transforming your manual claims process into a digital journey , you need to know what your target is, and what you want your FNOL solution to end up looking like before you can get there.

Claims are complex, but they don't have to be complicated.

[.emph]The right FNOL solution will make your claims process easier for your employees and customers alike, giving you a fresh opportunity to build trust in your company through faster service. [.emph]

A digital FNOL solution not only streamlines the claims process, it also enables you to provide a better digital customer experience.

An effective claims FNOL system will help companies achieve their goals without sacrificing accuracy or efficiency. If your company's current solution is holding you back from developing the best service possible for your customers, then it may be time to go digital.

And timing couldn't be better. This year, digital FNOL will become the norm : the US insurance market is transitioning to e-submissions of the First Notice of Loss, and more insurers are following suit.

What are the benefits of a digital FNOL?

In today's world, where smartphones are prevalent and people expect immediate access to information, carriers often feel stuck in a time warp with claims processing. A digital FNOL system allows an insurer to gather claim information directly from the policyholders via digital means. Policyholders can send their data via mobile apps, messengers, social media, email or other means.

A digital FNOL system allows an insurer to reduce claim cycle time and provides faster, more accurate claim information that has historically taken days or weeks to obtain with paper-based processes. Carriers can provide a better customer experience by reducing the time it takes for a claim to be resolved and the delay in receiving payment checks.

According to Gartner, the industry is currently experiencing a "shift to mobile." The average user engages with five different consumer-facing digital offerings each hour. Insurance companies must either develop their own apps or, like other businesses, work through app stores and offer claims data for consumption by the carrier's customers.

The goals for digital platform should focus on maximizing operational efficiency throughout the entire claims resolution process. The key areas where improvements can be made through digital FNOL include:

- Better customer experience through real-time, two-way communication between carriers and policyholders

- Reduced cycle times

- Reduced costs through data accuracy and automated workflows

- Increased productivity with mobile workforces

- Reduction of operational costs

- Better data quality and insight into claims information for risk-based pricing

- Ability to deliver product and service customization based on the information carriers receive from policyholders

- Better accountability and quality controls in claims processing

- Decreased fraud and abuse

- Improved geolocation functionality to identify the most appropriate adjusters for each claim

- Advanced analytics that allow carriers to better manage claims with actionable insights into workflow improvements.

Transforming your FNOL process to digital

The industry is driving the digital transformation, not just carriers. As discussed above, customers are demanding faster service and insurers must respond to meet these needs by leveraging the latest technology.

It's time for insurers to upgrade their claims systems with a modern solution that provides flexibility and customization capabilities to meet insurers' needs. Without an upgraded solution, insurers will continue to be behind the curve and find it increasingly difficult to keep pace with customer expectations.

As digital FNOL becomes the standard, now is the time to start planning for your transition as a path to future-proofing your business.

So, how do you know what your solution should look like (or if you even need one)? Before launching a digital FNOL journey, it's important to clearly define your goals and identify the steps required to meet them.

Let's get started with the critical questions before committing resources to your digital FNOL strategy.

Questions to ask yourself before upgrading your digital FNOL

FNOL has traditionally been a slow and cumbersome process with old applications that are difficult to maintain without breaking customer experience or business workflow consistency.

Claims systems are typically over ten years old, with many having been customized heavily to meet individual carriers' requirements. Legacy technology has led to a patchwork of codebases that are difficult to change or update. Yet this lack of flexibility prevents carriers from leveraging the latest advances in innovative technologies available today.

For those carriers who are planning to implement digital FNOL to support its core internal operations and workflows we will provide 23 questions your team should answer to ensure a successful transition.

Running an insurer's claims function is a complicated, highly regulated activity shared across many functions, business units, and even companies depending on the carrier's business model.

With Digital FNOL, you are piggybacking your customers' devices to collect information, so securing the data is an issue carriers need to address upfront before implementation.

[.emph]Successfully integrating a digital FNOL solution is a complex, multi-phase project.[.emph]

Here are the questions you must ask yourself and your team before embarking on this journey:

Set up goals and KPIs

1. What business goals are you trying to achieve through digital FNOL?

This question is best answered by your claims team - but managers and executives must understand why they're doing this for them to provide support throughout the implementation process.

2. What are the specific pain points you want to solve?

This question is critical in identifying who will use this system, what information they need it to capture, and when they will need it. By understanding your users' needs, you can ensure that your solution really solves their problems.

3. How will you measure the success of your solution?

Understanding a carrier's previous pain points and goals for their digital FNOL solution should help them benchmark the ROI they achieve from it, so this question is just asking them to do that too. If you have an idea of what timescale you're working to then that would also be useful here.

Scope your project

4. How much time do I have to complete this project and how much money will it cost?

This can be a hard question to answer, and often you won't know for sure until you get started, but it's important to have a rough idea of what resources are needed and how long it will take. Large enterprise companies may need upwards of six months and millions of dollars before they can go live with their digital FNOL solution.

5. What is your budget and what approach will you take to a digital FNOL?

When determining whether to use an internal IT team or an external developer, carriers should consider the time it takes to implement, change and maintain the solution. Your business needs may outweigh this factor though, so if your aim is to get up and running quickly you should opt for a no-code option.

This question can help carriers identify the most cost-effective option for implementing a digital FNOL solution, whether that's an in house team, working with a tech vendor, or going no-code.

This question has already been answered in our previous article "9 ways no-code development platforms create value in insurance and banking".

6. How will our customers benefit from this technology?

Planning out how increasing efficiency and accuracy will improve the customer experience in a tangible way is critical in selling the benefits of your digital FNOL system to management, business units and potentially your customers.

7. How will our employees benefit from this technology?

With greater accuracy and simplicity, your claims team will have more time to spend on customer service which should result in happier employees and eventually happier customers. However, before you introduce the solution, it's important to communicate how it works so that your staff is prepared for the changes ahead.

8. How will this solution benefit our company?

This is the ultimate question to consider when looking at your options for digital FNOL. If you can't answer this question in a meaningful way, then it's probably not the right choice for your carrier. New technology always comes with trade-offs, but if you can identify where your company could save money or increase revenue then you're moving in the right direction.

9. What are the potential drawbacks of this solution?

No matter how much planning you do, there will still be things that go wrong when you go to implement your digital FNOL solution. It's important to consider what these might be and whether they are manageable within your timeframe.

Define your technical requirements

10. What third-party integrations do you need?

[.emph]To create a new digital FNOL program, carriers will first need to evaluate their current claims system architecture and determine if they want to keep some legacy programs in the mix. [.emph]

Carriers may also find that one good option is to use cloud technology as it ensures the system will be up-to-date.

In complex claims management systems, it may not be possible to customize the technology stack to their needs, and carriers will need to connect to other external services. If a carrier has an existing POS system, CRM, or analytics tools they will need to ensure that these are connected with the digital FNOL solution. Carriers should also consider how to integrate the solution with their current system landscape, as they are likely to have many different legacy funding modules in place.

Additionally, funding modules are expected to become fully automated via digital FNOLs. The ability for carriers to know exactly what is being paid out on each claim, where and when is critical to cost control. To create a new system, carriers will need to determine if they want to build one from scratch or buy an integrated claims solution that can be customized to their needs.

11. What technologies do I need to support my solution?

Digital FNOL solutions are made up of many different tools and systems, from crowdsourcing apps to geolocation mapping, so choosing the right blend for your company requires a thorough understanding of the technologies available and how they work together.

12. How will you integrate this system with your carriers' internal systems?

Since many digital FNOL solutions are designed to work seamlessly with existing carrier software, it is important to ensure that the customer's systems are compatible. This may include compatibility testing or other types of preparation prior to full-scale implementation.

13. What regulatory and industry standards must your Digital FNOL be compatible with?

Carriers should ensure that their technology stacks are compliant with existing industry-specific regulations such as HIPAA, GDPR etc. They should also be familiar with the state variation in carrier licensing requirements, since these may affect how carriers choose their technology partner or internal solution.

14. What's my plan for data migration and storage?

Since you will be processing a lot more information than before, it is important to consider how your carrier will store and secure this additional data. Digital FNOL solutions come with different requirements and constraints on how users can access or share collected claim information, so knowing these beforehand will enable you to choose a system that meets your carrier's security standards.

15. How much data will be input and processed on a daily basis - and how accurate do you need that data to be?

There is often a correlation between how much data is collected and how accurate that information needs to be. Consider the nature of your claims operation and who will input this data - there might be one claim with 10 images or 100 claims with just one image each – but both require users to take snapshots of their device screens.

16. What features are essential to the new FNOL process, and which can be sacrificed if necessary?

This is the time to think about what your priorities are based on industry best practices, and be sure that these requirements are included in your design choices. For example, would you need a co-browsing functionality that will allow your support team to assist user in real-time? What about supporting documentation upload, eSignatures or integrations with your internal systems? Map out your project, taking into account all features you will need.

Ensure a buy-in from stakeholders

17. Who needs to be involved in the process?

Since a digital FNOL solution will affect so many people throughout your company, it's important to build a team with representatives from various divisions and levels of seniority. Include customer service, claims, sales and marketing representatives in your deliberations.

18. How will you roll out your solution to stakeholders across the company?

Having a good idea of who will need training or access to the solution before it is rolled out can help carriers ensure they have all the necessary resources in place for success, and allows them to set expectations about what this new system means for their stakeholders.

The upside to these questions is that they can be used as a framework for carriers looking to implement their first digital FNOL solution and prepare them for the journey ahead. The downside is that they're no substitute for experience, and it takes time and effort to answer them well - particularly if you don't have the knowledge or network to do so, which is why hiring an external technology partner can be beneficial.

Once carriers have asked themselves these questions and are confident in their approach they can move on to more strategic concerns about their digital FNOL solution. These might include setting up the right governance model, choosing the best user interface/design for your company, or creating a roadmap for your solution's development.

19. How much training will staff require in order to use the upgraded system effectively - and is that training available in-house or externally?

Digital FNOL implementations can be complex and it is impossible to know exactly what features you'll need until after you begin the design process. Training in-house staff will save money, but it may delay your project timeline and cause issues down the road when employees leave and need to be replaced.

[.emph]External training services offer a good option if you have limited resources or need to have your staff trained quickly.[.emph]

20. How will this implementation affect current workflow, policies and procedures?

Before you begin an implementation process, it is important to identify how the solution's features will alter these practices - are there specific ways that you want users to input data into the system? What default settings do not align with your carrier's internal policies?

21. What processes will need to change?

Often people tend to focus on implementing new technologies rather than evaluating how existing functions will work with their digital solution. It's important to plan out how your digital solution fits with current processes so that you can quickly identify where to make any adjustments.

Assess the vendors

22. What type of support will be available?

Even the most well-thought out digital FNOL solution can still run into problems, but choosing a partner that offers reliable technical assistance, including 24/7 customer service can reduce frustrations in these difficult situations.

23. What is the total cost of ownership?

Often overlooked in the excitement over new technology, figuring out the long term costs associated with your digital FNOL solution is critical to making the right choice. And that was the ultimate set of questions to ask before you implement your new FNOL system.

When it comes to time to market and total cost of ownership, no-code solutions have the edge. By eliminating the costly and time-consuming effort around building out frontend applications and backend integrations for your FNOL workflow, no-code solutions can pass those savings directly on to carriers, reducing the total cost of ownership by as much as 50%.

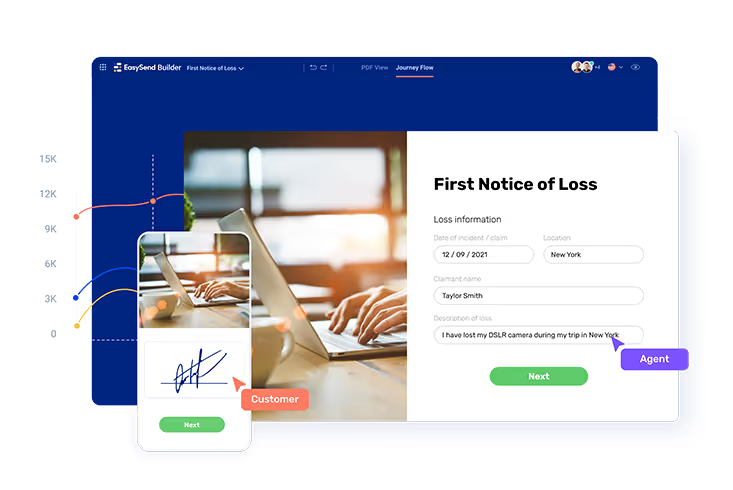

Create a digital FNOL process in 24 hours with Easysend

Create a digital FNOL journey that tells your clients exactly what they need to upload, making it easier to determine the fault or settlement. Just text or email the link, then support in real-time with Co-Browsing. You'll shorten the lifecycle, save on valuable resources, and be there when your customers need it the most.

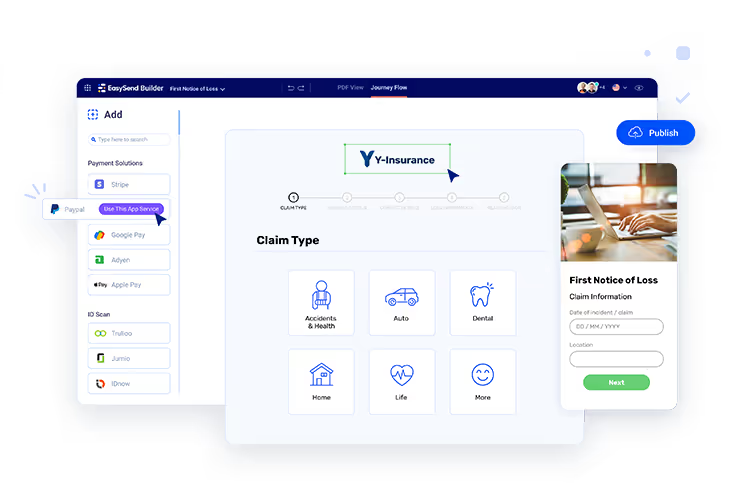

1. Request a FNOL template

You’ll get five professional service hours so you can hit the ground running.

2. Customize it and connect any third-party app

Adjust your template and emails to match your brand’s look and feel.

3. Launch your first digital journey

Send a link to your customers in a click or make it accessible online.

.avif)

.avif)

.avif)

.avif)