No-code platforms are transforming how regulated industries operate — not by replacing core systems like CRMs or policy admin tools, but by bridging the gap between internal data and real-world customer interactions.

If you're still relying on PDFs, call centers, and fragmented email threads to manage complex workflows, you're falling behind.

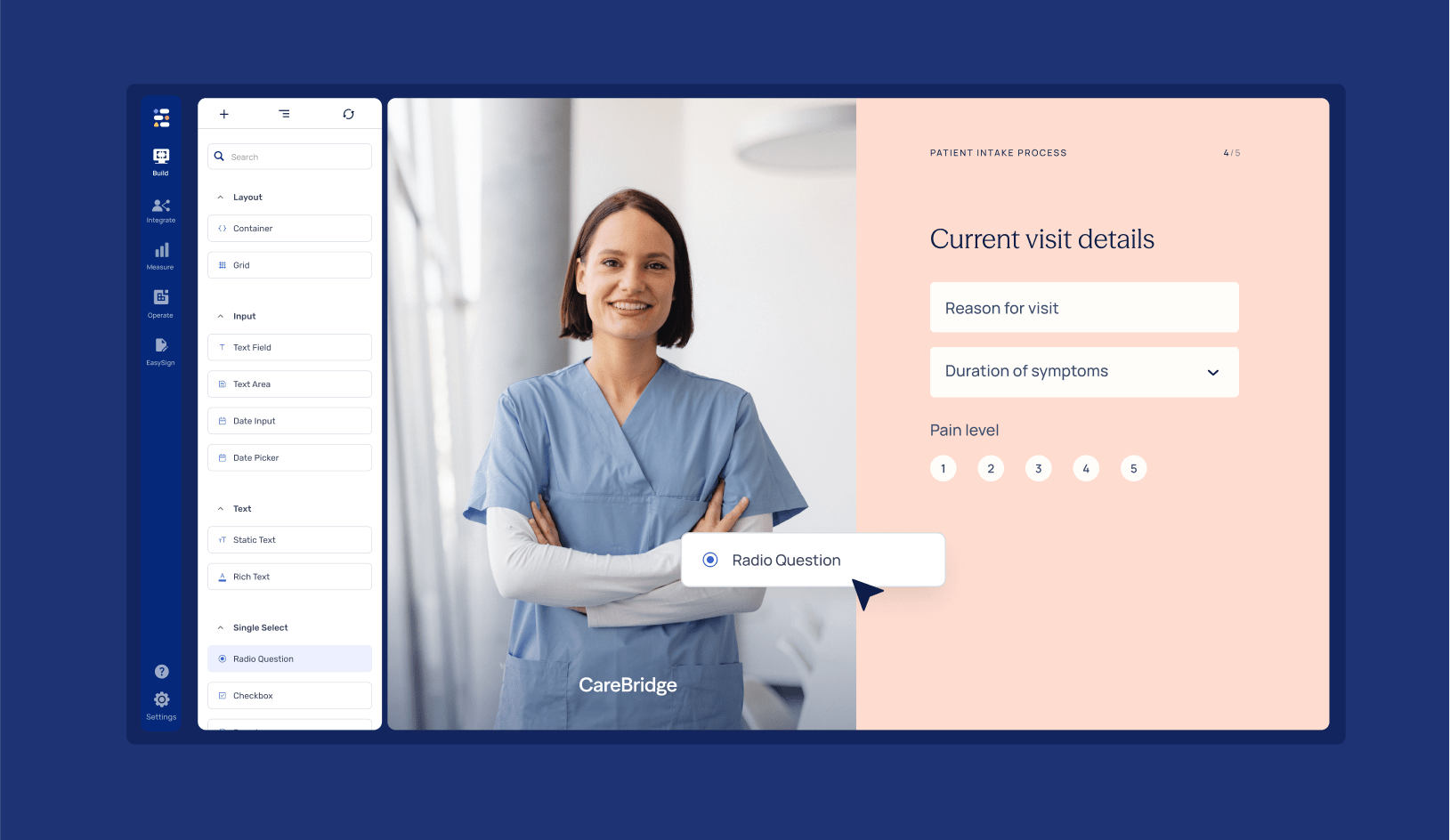

In regulated industries like insurance, banking, and wealth management, processes often span multiple stakeholders, conditional rules, and compliance-heavy documentation. A no-code workflow builder empowers business teams to digitize these flows without writing code, while maintaining security, control, and auditability.

Let’s explore the top 5 high-impact use cases where no-code workflow builders are redefining operational efficiency, customer experience, and compliance in regulated environments.

1. Claims intake and First Notice of Loss (FNOL) – Insurance

Why it matters:

The claims process is where trust is either built or broken. FNOL is typically chaotic — involving phone calls, paper forms, multiple approvers, and document uploads.

Problems today:

- Static PDFs or web forms with no logic

- High drop-off rates due to complexity

- Manual data entry into core policy systems

- No way to guide customers in real time

No-code workflow solution:

With a no-code platform like EasySend, insurers can launch dynamic, guided FNOL flows that adapt to customer input, include conditional logic for claim types, and route approvals internally. You can even offer Sign Together sessions for real-time agent-customer collaboration.

Outcome:

- 70% reduction in onboarding and claims time

- Fewer support calls

- Real-time validations and uploads

- Better compliance tracking and audit trail

2. KYC/AML onboarding – Banking & Fintech

Why it matters:

Onboarding new customers is one of the most regulated and risk-sensitive workflows in financial services.

Problems today:

- Fragmented processes across systems and departments

- Duplicate document requests

- Poor visibility into what’s missing or complete

- Delayed compliance approvals

No-code workflow solution:

A no-code journey builder allows banks and fintechs to create smart onboarding workflows that dynamically collect ID documents, prefill known data, request eSignatures, and route approvals across KYC, AML, and legal teams. Real-time updates to CRM and core banking systems ensure no data is lost.

Outcome:

- Faster time-to-KYC

- Complete audit trail of each interaction

- Reduced operational workload

- Improved customer satisfaction and retention

3. Investor onboarding – Wealth & fund management

Why it matters:

Onboarding LPs, clients, and partners in hedge funds or private wealth firms involves multi-party collaboration, high-value documentation, and strict regulatory controls.

Problems today:

- Dozens of PDF variations by region, entity, or investor type

- Manual email follow-ups for missing data or signatures

- Sensitive information scattered across threads

No-code workflow solution:

EasySend replaces 10+ document versions with a single, dynamic workflow. Stakeholders like the investor, advisor, and compliance officer can sign in parallel, while built-in validations ensure completeness before submission.

Outcome:

- Reduced onboarding time by 50–70%

- Lower error rates and compliance risks

- Full visibility into investor progress

- Real-time syncing with fund admin platforms or CRMs

4. Policy change requests – Insurance

Why it matters:

Post-sale interactions like beneficiary changes, address updates, or coverage modifications often generate high call volume and operational overhead.

Problems today:

- Customers must call or email to make changes

- Static forms don’t reflect current policy data

- No validation logic for acceptable changes

- Teams manually review, approve, and file updates

No-code workflow solution:

Use a no-code tool to create policy servicing journeys that connect to core policy systems, show only relevant options, validate fields instantly, and collect supporting documents and eSignatures — all from the customer’s preferred device.

Outcome:

- Fewer calls to the contact center

- Faster turnaround for policy changes

- Reduced compliance and documentation errors

- Better customer self-service

5. Loan origination & financial document collection – Lending

Why it matters:

Loan origination is a document-heavy, time-sensitive process. Customers need to submit income verification, IDs, bank statements, and more — usually to multiple parties.

Problems today:

- Paper-based or rigid online forms

- No real-time data syncing

- High dropout due to complexity

- Errors from manual document handling

No-code workflow solution:

Lenders can use no-code platforms to deploy fully guided workflows with step-by-step document intake, dynamic branching based on loan type or geography, and integrated eSignatures. Documents can be uploaded, validated, and routed to the right team instantly.

Outcome:

- Reduced time to approval

- Fewer rejected applications

- Seamless customer experience

- Audit-ready workflows

Final thoughts: No-code is built for regulated complexity

These aren’t “nice-to-have” improvements. They’re mission-critical upgrades to how regulated industries operate in 2025.

With the right no-code platform, you can:

- Remove dependency on dev cycles

- Launch and update digital journeys quickly

- Ensure compliance through built-in logic

- Improve NPS, reduce costs, and move faster

EasySend is purpose-built for regulated workflows with:

- Native integrations with Salesforce, core systems, and CRMs

- Parallel, serial, and Sign Together signature modes

- Full compliance (SOC2, HIPAA, GDPR, ISO 27001)

- Drag-and-drop builder for complex flows — no code required