Technology is dictating the pace of change in every sector, including insurance. So what happens when people - for whatever reason - don’t have access to technology? The answer is a digital divide - a gap in access to digital tools and the internet - which severely limits the ability of a significant portion of the population - to access insurance.

As insurers increasingly rely on digital platforms for their workflows and processes - from digital data intake to service creation, distribution, and delivery - consumers without access are at a massive disadvantage. This has created a paradox; while technology is helping to simplify and improve our lives, it’s also created an excluded class of people on the wrong side of this digital divide.

So what can be done to bridge the gap?

A closer look at the statistics

The digital divide is a complex issue influenced by several factors, including age, income, geographic location, education, and more. In the United States, this disparity reveals a stark picture of inequality, which directly impacts insurance accessibility and financial stability for many people.

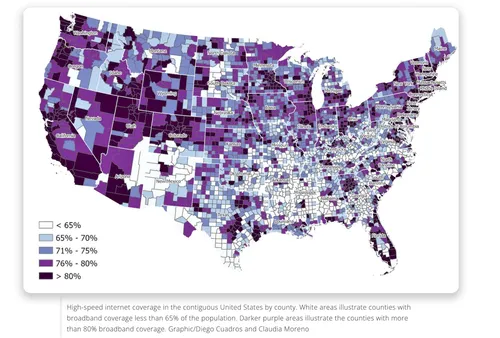

The above graph from 2023 shows the high-speed internet coverage across the contiguous United States by county, and starkly displays the geographic disparities in terms of access to the internet.

Clearly, counties with less than 65% broadband coverage (of which there are many) are more likely to experience a digital divide. This means that residents in this area probably find it more difficult to digitally access insurance services, obtain quotes, manage their policies, or file claims.

There are several factors impacting this digital gap, including:

Geography

Urban areas in the US tend to have more and better internet coverage versus rural areas. This is backed by reports by the Pew Research Center stating that rural residents go online less often than urban residents.

Age

Age is another strong factor driving the digital divide. According to Frontiers in Public Health: “With the rapid development of digital health today, the lack of digital health literacy in older adults is an urgent problem.”

Pew Research also claims that American adults who are 50 and older are less likely to own a smartphone than adults under 50.

Race

According to a 2021 study done by Florida Atlantic University, the Dana-Farber Cancer Institute, and the University of Massachusetts Medical School, race is another factor in this gap, disproportionately affecting Black, Hispanic, and Afro-Caribbean adults aged 60 and older.

Education

Levels of education further compound the digital divide. Individuals without a college degree are less likely to have home broadband or own a smartphone, limiting their access to digital resources and services, including online insurance applications and information.

Socio-economic levels

Pew also claims that people in US households bringing in over $100,000 annually are far more likely than those earning less than $30,000 per year to own a smartphone (98% vs. 79%).

The risk of the growing digitalization gap in insurance coverage

The above statistics make one thing clear: As the insurance industry digitalizes, a significant portion of the population risks being left behind - uninsured or underinsured due to a lack of digital access.

Technology's role in closing the digital insurance gap

As a result of this increasing digital divide, the insurance industry is seeking ways to extend its reach. Ironically, technology itself is playing a large part in bridging the gap. Here are a few examples:

- Mobile apps requiring low data usage

Smartphone penetration is continually rising. In fact, people in lower-income households are particularly likely to rely on their smartphones to go online (Pew Research). Many insurers are developing mobile apps that require only minimal data usage, enabling users in areas with limited internet access to obtain insurance services. These apps tend to also include features like offline access to insurance documents and the ability to process claims without a constant internet connection. - Artificial Intelligence

AI is changing the way insurers interact with their customers, making services more accessible and user-friendly. Chatbots and virtual assistants that are powered by AI provide 24/7 customer service, guiding users through different insurance processes and workflows with greater ease. This is especially relevant for aging populations and other customer segments who tend to be less tech-literate.

AI is also playing an important role in simplifying the underwriting process, which means quicker policy quotes and approvals. This tends to lower technological barriers for people who struggle with digital literacy. - No-code platforms

Using no-code platforms, insurers are now able to quickly deploy user-friendly digital solutions tailored to the needs of different demographics. By reducing costs and technical barriers, insurers can deliver tailored, responsive, and scalable digital tools that have been designed with the end-user in mind.

These technologies aren’t just changing how insurance services are created and delivered - they’re altering access to these services by developing user-friendly, accessible technology solutions.

Designing for everyone: The importance of user-friendly interfaces

As insurers continue to develop their digital offerings, ensuring that the design of their platforms serves all users equally is essential for inclusivity and ensuring everyone has the means to access insurance services.

Simplicity is key

The most effective digital insurance platforms offer a clean, straightforward user interface. Minimizing complexity and avoiding industry jargon helps to make it easier for users to find the information they need and complete necessary actions, such as applying for coverage or filing a claim.

Responsive design

A growing number of users exclusively access the internet via their smartphone or tablet, making responsive design essential. Insurance platforms that can seamlessly adjust to different screen sizes and orientations ensure that users can access services regardless of the device they’re using. This flexibility is especially important for reaching users in areas where mobile devices may be the primary means of internet access.

Accessibility features

For users with disabilities, features such as screen reader compatibility, keyboard navigation, and alternative text for images ensure that users with visual impairments, hearing loss, or mobility challenges can navigate insurance platforms independently.

Multi-lingual support

Recognizing the linguistic diversity of the user base, multilingual support is crucial for making insurance platforms accessible. Providing services in multiple languages helps non-English speakers navigate platforms with more ease, ensuring a wider segment of the population can benefit from insurance services.

Insurance companies are leading the way to inclusivity and accessibility

Several companies are already harnessing technology to reach underserved markets. Their innovative approaches not only demonstrate the potential of digital tools in bridging the gap but also set a precedent for the industry.

- Lemonade

Leveraging AI and machine learning, Lemonade transforms the insurance experience for its users. Its AI-powered chatbot simplifies the process of purchasing insurance and filing claims, making it accessible to people who might be navigating an insurance website for the first time. By reducing complexity and increasing efficiency, Lemonade can serve a wider demographic, including younger consumers as well as users who may not be tech-savvy. - Oscar Health

Oscar Health uses technology to personalize healthcare insurance. With a user-friendly interface and a mobile app that allows for easy doctor visits and prescription management, Oscar targets individuals who traditionally face barriers to healthcare access, such as those with fluctuating incomes or living in rural areas. Their use of data analytics to guide users to in-network providers ensures cost-effective care. - Root Insurance

Specializing in car insurance, Root Insurance uses smartphone technology and telematics to offer rates based primarily on driving behavior rather than demographics. This approach provides a fairer and potentially lower-cost option for young drivers, seniors, and people living in areas with higher insurance rates due to demographic factors. By focusing on individual behavior, Root makes insurance more accessible to groups typically facing higher premiums.

Towards a future of inclusive insurance

Bridging the digital divide isn’t the responsibility of a single entity but a collective endeavor that requires commitment from insurers, policymakers, and technology providers alike. Together, we have the power to reshape the landscape of insurance accessibility, ensuring that the benefits of digital transformation are shared by all.

Insurers should continue innovating and investing in technologies that make insurance more accessible. By embracing user-friendly design, mobile solutions, no-code platforms, and AI, insurers can break down barriers and reach underserved markets.

Policymakers need to implement regulations that encourage innovation while ensuring consumer protection. By investing in infrastructure that expands internet access to rural and underserved areas, policymakers can create an environment where digital insurance thrives. Supporting education and digital literacy programs is also vital, providing citizens with the skills needed to navigate the digital world.

Technology providers should collaborate closely with insurers to develop solutions that are not only advanced but also accessible. The focus should be on creating intuitive, flexible, and inclusive platforms, emphasizing the specific needs of diverse user groups. By prioritizing accessibility in the development process, technology providers can ensure their innovations serve as bridges rather than barriers.

The path toward digital inclusion in insurance is a journey that requires constant improvement and collaboration. By prioritizing inclusivity as a fundamental aspect of insurance service development and distribution, we can ensure that the digital age benefits everyone, regardless of their demographic or socioeconomic status.