Annual premium adjustments are a fundamental aspect of the insurance industry, designed to ensure the sustainability and relevance of insurance policies in the face of changing risk profiles, regulatory landscapes, and market conditions. These adjustments allow insurers to recalibrate premiums to reflect the current risk environment accurately, ensuring that policy pricing is both fair to consumers and viable for insurers.

Understanding the drivers

Several key factors necessitate the annual adjustment of insurance premiums:

- Risk Evolution: As businesses evolve, so do their risk exposures. Changes in operations, expansion into new markets, or the adoption of new technologies can alter a company's risk profile significantly.

- Regulatory Changes: Insurance is a highly regulated industry, and changes in laws or regulations can impact the costs of providing insurance, necessitating adjustments in premiums.

- Market Dynamics: Economic conditions, competition, and claims trends can influence the cost of insurance, requiring annual adjustments to keep premiums in line with current realities.

- Claims Experience: The previous year's claims experience can significantly affect future premiums, especially if the frequency or severity of claims deviates from expectations.

The current state of insurer-customer interactions

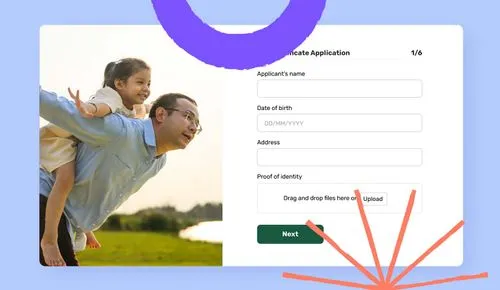

Traditionally, insurers have relied on multiple, disconnected point solutions to manage customer interactions. These solutions often involve manual processes, including paper forms and direct communications via phone or email. This method is not only time-consuming but also prone to errors, leading to a disjointed customer experience and inefficiencies in data management.

Annual premium readjustments, under this model, become a cumbersome process, requiring significant manual effort to collect and analyze customer data to make informed decisions. The problems arise in multiple areas such as:

- Data Management: With the use of paper forms and manual data entry, there is a high risk of errors and incomplete information. This can lead to inaccurate premium calculations and difficulties in tracking customer data over time.

- Customer Communication: The lack of a centralized system for managing customer interactions makes it challenging to maintain consistent communication with customers. This can result in delays and confusion, leading to a poor customer experience.

- Efficiency: The manual processes involved in managing insurer-customer interactions can be time-consuming and resource-intensive. This leads to inefficiencies and increases the cost of operations for insurance companies.

Enter the dynamic customer interaction layer

The dynamic customer data interaction layer represents a paradigm shift in how insurers collect, manage, and utilize customer data. This built-for-purpose platform streamlines the entire process of customer interactions, making it adaptive, real-time, and responsive. It integrates seamlessly with insurers' workflows and core systems (like BPMS, CCM, etc.), eliminating the need for multiple disconnected point solutions.

Core capabilities:

- Dynamic Customer Interactions: The platform adapts to customer input in real-time, ensuring a responsive and personalized interaction experience across any channel.

- One Platform for All Interactions: It consolidates all customer interactions into a single, unified platform, enhancing efficiency and coherence.

- Fully Integrated System: By being fully integrated with insurers' core systems, it ensures that data flows smoothly between customer interactions and the insurer's internal processes.

- Multi-Touchpoint Communication: It supports consecutive or non-linear communication, following the customer across various channels and touchpoints without being bound by a rigid process.

Solving key problems

The introduction of a dynamic customer data interaction layer addresses several pressing issues in the insurance sector:

- Eliminating Unfit Point Solutions: It replaces inadequate solutions with a purpose-built platform, designed specifically for seamless customer interactions.

- Digital Adoption Challenges: The platform overcomes the limitations of existing solutions, facilitating easier and more effective digital adoption.

- Unifying Fragmented Digital Initiatives: By offering a unified platform, it integrates fragmented digital efforts into a cohesive strategy.

- Overcoming Rigid Digital Interactions: The flexible nature of the platform eliminates the friction and "ping-pong" effect of disjointed digital communications.

Strategic Benefits

The strategic advantages of adopting a dynamic customer data interaction layer are profound:

- Built-for-Purpose Technology: Tailored specifically for the insurance industry, ensuring every customer interaction is smooth and hassle-free.

- Dynamic Interaction Layer: Allows for the dynamic tailoring of processes, breaking free from rigid, predefined interactions, fully integrated with core systems and workflows.

- Enhanced Adoption: Significantly reduces friction, fostering adoption, and scaling digital efforts more effectively.

Dynamic customer interactions for premium adjustments

The shift towards a dynamic customer data interaction layer signifies a leap forward in insurance data management. It not only enhances the efficiency and accuracy of annual premium readjustments but also revolutionizes the customer experience. By moving away from fragmented, manual processes to a unified, digital-first approach, insurers can significantly improve operational efficiency and customer satisfaction.

Successfully navigating the annual premium adjustment process requires a strategic approach that balances the needs of policyholders with the financial health and regulatory compliance of the insurance company.

Integrating technology for enhanced efficiency

The adoption of no-code platforms and sophisticated customer interaction layers plays a pivotal role in streamlining the data collection process. These technologies allow insurers to:

- Streamline Customer Data Collection: Through dynamic customer interactions, insurers can automate the intake of critical risk-related information directly from clients. This not only speeds up the process but also reduces errors associated with manual data entry.

- Engage with Customers Dynamically: A robust customer interaction layer enables insurers to engage with policyholders in real-time, collecting up-to-date information about changes in their business activities, risk exposures, and insurance needs. Collecting complex input from multiple people in an organization becomes simplified through this approach.

- Analyze Data in Real-Time: By harnessing the power of real-time data analytics, insurers can quickly adjust premiums based on the latest information, ensuring that pricing remains competitive and aligned with the risk.

Continuous improvement and adaptation

The landscape of risk and insurance is constantly changing, and insurers must remain agile, continuously refining their approaches to premium adjustments. This involves regularly updating data intake processes, enhancing customer interaction mechanisms, and adapting no-code platforms to meet emerging needs.

The bottom line

Navigating business insurance premium adjustments is a multifaceted challenge that requires a strategic approach, underpinned by advanced technology and a commitment to customer engagement. By leveraging data-driven insights, integrating no-code platforms for efficient data intake, and prioritizing transparent communication, insurers can manage annual premium adjustments effectively. This not only ensures financial viability and regulatory compliance but also strengthens the relationship with policyholders, paving the way for long-term success in the competitive insurance landscape.