TL;DR

Most loan applications still rely on static forms and document checklists that were never designed for real borrower behavior or modern lending complexity. Guided, dynamic application journeys replace rigid forms with adaptive flows that validate data in real time, coordinate multiple participants, and collect only what is relevant. The result is faster completion, cleaner data, and lower operational overhead—without replacing the Loan Origination System.

Loan origination has evolved dramatically on the back end. Decisioning engines are more sophisticated, compliance is more automated, and underwriting workflows are increasingly digital. Yet the front door—the point where borrowers actually enter data—often remains stuck in a form-first mindset.

This disconnect creates friction that ripples through the entire origination process. Borrowers abandon applications, operations teams chase missing information, and underwriters wait on documents that should have been validated before submission. In many cases, the problem is not the LOS or the credit model. It is the way data is collected.

To move forward, lenders need to rethink loan application intake not as a form, but as a journey.

Why forms struggle in modern loan applications

Forms are designed to capture inputs, not to guide people through complex decisions. They assume a single, linear path and a uniform borrower profile. In lending, neither assumption holds.

Borrowers differ widely in employment type, income structure, collateral, loan purpose, and regulatory exposure. Static forms either ask for too much information upfront—creating friction and confusion—or too little, which leads to follow-ups, rework, and delays later in the process.

Even when forms are embedded in digital portals, the experience rarely improves in a meaningful way. The same rigid structure simply moves from paper to screen. The lender still ends up validating data after submission, coordinating participants manually, and handling documents as disconnected attachments rather than structured inputs.

What changes when intake becomes a journey

A journey-based approach treats loan intake as a guided process rather than a single event. Instead of presenting a fixed set of fields, the experience adapts continuously based on borrower input and context.

As a borrower progresses, the journey determines what to ask next, which documents to request, and whether additional participants are required. Questions that are irrelevant never appear. Requirements that depend on earlier answers are triggered automatically. Errors and inconsistencies are flagged immediately, while the borrower is still engaged.

This shift fundamentally changes the quality of data entering the system. Information arrives structured, complete, and decision-ready, rather than fragmented and ambiguous.

Document intake is where journeys deliver the biggest impact

In practice, most loan delays are driven by document issues rather than credit decisions. Borrowers upload the wrong files, miss pages, submit outdated versions, or misunderstand what is required. Traditional portals treat this as inevitable and rely on manual review to catch problems later.

Journey-based intake approaches document collection differently. Documents are requested only when relevant, based on confirmed borrower data. Validation rules ensure that uploads meet expectations before the borrower can move forward. Signatures occur in context, as part of the flow, instead of as a disconnected step at the end.

By turning document intake into a controlled, logic-driven process, lenders reduce back-and-forth communication and significantly shorten time to completion.

Handling multi-party applications without manual coordination

Many loan applications involve more than one participant. Co-borrowers, guarantors, and internal approvers often need to provide information or sign documents. Static portals are not designed for this level of orchestration, which is why so much coordination still happens over email.

Journeys introduce role awareness into the intake process. Each participant is invited at the right time, sees only what is relevant to them, and completes their part without confusion or overlap. Dependencies are enforced automatically, and progress is tracked across all parties.

This removes a major source of operational drag while improving transparency for both borrowers and lending teams.

The role of real-time validation

One of the most important—but often overlooked—advantages of journey-based intake is real-time validation. Instead of identifying issues after submission, lenders can prevent them altogether.

As data is entered, formats, ranges, and logical consistency are checked immediately. Required fields cannot be skipped. Contradictory answers are flagged before they become downstream problems. This dramatically reduces manual review effort and improves decision speed.

Clean data at the point of entry is one of the strongest predictors of efficient loan origination.

How this fits with your LOS

A common misconception is that the Loan Origination System should own the borrower experience. In reality, LOS platforms excel at decisioning, compliance, back-office workflows, and auditability—but they are not designed to serve as flexible, customer-facing interaction layers.

The most effective architectures separate responsibilities. A dedicated journey layer handles data collection, document intake, validation, coordination, and experience. The LOS receives structured, high-quality data and executes its core functions without being burdened by front-end complexity.

This separation allows lenders to evolve intake experiences quickly without destabilizing core systems.

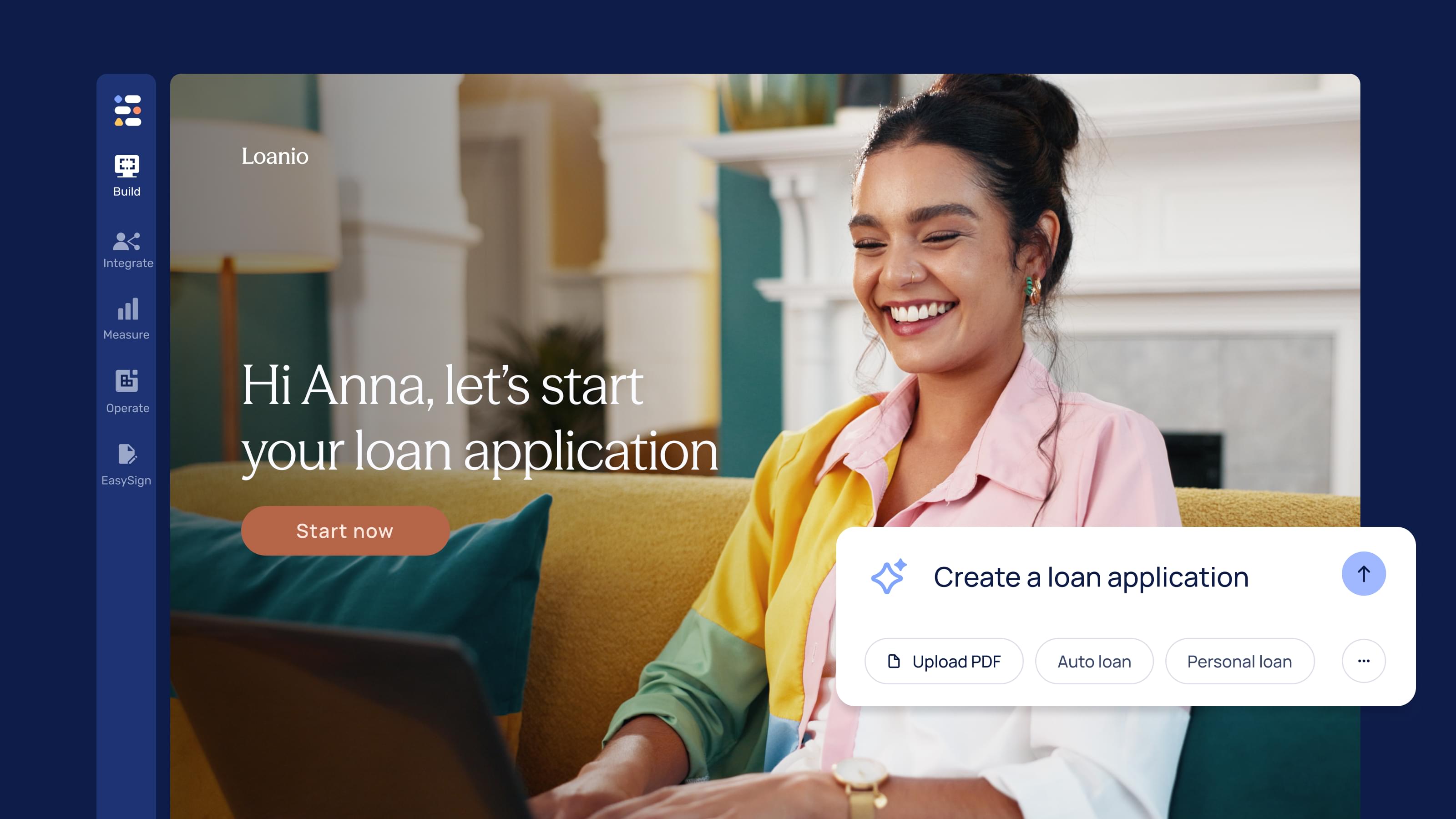

How EasySend supports journey-based loan intake

EasySend was built to power this front-door layer. It enables lenders to design guided loan application journeys with dynamic logic, real-time validation, multi-party coordination, and embedded eSignatures.

Journeys can be configured by business teams using no-code or low-code tools, while integrations ensure seamless data flow into existing LOS platforms. This allows lenders to modernize intake without replacing their core infrastructure.

The result is a borrower experience that feels intuitive and responsive, paired with operational workflows that are faster and easier to manage.

The shift lenders can no longer postpone

Loan origination is no longer differentiated solely by rates or products. Experience, speed, and data quality increasingly determine who wins and who loses.

Static forms and generic portals belong to an earlier phase of digital lending. The future lies in intelligent, adaptive journeys that guide borrowers, reduce friction, and deliver decision-ready data from the start.

Moving from forms to journeys is not just an upgrade. It is a necessary evolution.