No matter the industry, digital is your best friend. It increases the value of every product and service, changes how organizations perform, and is a viable option to stay competitive in a digital-first world. And if you are not transformed yet, the chances are that your biggest competitors have already made their moves, and you are now lagging behind.

Unfortunately, insurance is not yet where we want it to be - but there ARE ways out of the usual FUD (fear, uncertainty, and doubt) that stops organizations from reaching better futures faster.

[.emph]Digitally mature organizations do things differently. They use digital technologies to create new business models, leapfrog competitors and support their transformation towards a digital enterprise. [.emph]

Each organization needs to follow its own path of digital transformation, but there are some actions that we see as key repeatedly.

Here's what digital leaders in insurance do differently:

1 – they build cross-functional teams focused on the customer to drive digital strategy

One way digitally mature organizations go about digital transformation is by forming cross-functional teams to drive their digital strategy. These teams are composed of people from different departments, such as marketing, operations, and product development.

They act like mini businesses within the company because they have full P&L responsibility - which means they are accountable for revenue generation or cost savings. This ensures that each team focuses on meeting customer needs and creating new digital products and services.

2 – they continuously provide their customers with access to the most advanced digital experiences

While some might think that digitally mature organizations only invest in state-of-the-art technology, they also work on providing personalized and intuitive experiences for their customers. This means transforming how they build products and deliver services, investing in real-time digital interactions powered by artificial intelligence (AI), machine learning (ML), or chatbots.

3 – they experiment to test new ideas

When you experiment with your customers, you can discover game-changing opportunities before anyone else does. A good example of this is how the US insurance provider Progressive built a mobile app that uses video to determine how safely people drive. This is a fast and cost-effective way to understand how customers interact with their products and services, as well as identify new digital opportunities.

4 – they foster a culture of innovation

The best thing about digital transformation is that it becomes your fastest route towards digital business models. The only downside is that change needs to be embraced by top management and everyone else down the ladder. This means that your organization needs to create a culture of innovation where everyone feels comfortable identifying opportunities for improvement and developing new digital products and services.

5 – they are fast decision-makers

Taking several quarters to make important decisions is not an option anymore. Not only does everyone need to act quickly, but also you need to be prepared to fail fast and learn from your mistakes.

6– they eliminate initiatives that don't bring value quickly and stop doing them while focusing on the ones that do

If you keep too many initiatives alive, your customers will suffer because there is no clear focus. We know that insurance providers are holding onto multiple digital strategies at the same time, but this means they are not being effective with their resources or putting their customers first.

7– they design products in small increments instead of big ones (so you can always deliver improved versions)

Delivering products in small increments allows your organization to focus on the customer experience at every stage instead of building one big product that fails. Your customer-centric approach should guide you through what you need to do at each stage so you can release early, get feedback and iterate fast.

8- they use real-time customer and market insights to make decisions (and not gut feelings)

With access to the right data at the right time, your organization can make smart decisions that bring positive results quickly. Using real-time insights throughout the digital journey is essential because it ensures you are always acting on up-to-date information rather than hunches or guesses.

9– they collaborate with competitors (not avoid them)

In a digital world, customers do not care about organizational boundaries, so you need to collaborate across the industry to achieve your goals. This is how you can use each other's knowledge and skills to bring innovation to the market faster.

10 – they partner with startups (and suppliers) who have unique ideas and solutions

We know that insurance providers invest in many digital initiatives, but they are still failing to offer unique customer experiences. The solution is to partner with other organizations that have innovative ideas and solutions so you can scale up fast. This works well because startups do not have a complicated organizational structure that gets in the way of achieving goals quickly.

11- they don't fear failure: if you want fast, try fast and learn even faster!

A failed fast strategy means that your organization should be willing to risk making mistakes because the only way you will learn is by testing things out. Don't hold onto a failed idea or digital product for too long as this wastes resources and time which can be used to achieve success with something else.

12 - they stay away from the concept of 'this is how we always did it, or 'it's too complicated to change'

This one bad habit is difficult to get rid of. Insurance providers need to focus on becoming digital organizations rather than just thinking about digital as an add-on. This means that you should embrace the idea of creating a lean and agile business model that embraces changes as they happen.

Your organization can improve and become faster by embracing change. Digital transformation requires you to do things differently, and this means not getting stuck in your ways or following complicated processes that slow you down. Be willing to take the time to understand what is holding your business model back and how you can work around it, rather than ignoring problems.

13 – they know and embrace risk: they see it as par for the course and something you can always manage

Insurers are experts at managing financial risk. Transforming this skill set into the technology realm is the challenge they need to overcome. To do this, you should change your mindset when it comes to digital risk because it is incredibly valuable in digital transformation settings; what you need to focus on is how you make use of it.

14– they think about what value customers will get out of a product, not what features it should have

For an insurance provider, the customer experience is your product, so you should focus on maximizing value. Whether through price, convenience, or in-depth industry knowledge, customers need to receive something of value when they use your digital products and services. You can achieve this by removing unnecessary features or costs that are not beneficial for any party involved and improving the digital experience for customers.

15 – they use small experiments to test hypotheses instead of big, one-off exercises (prefer proof of concept)

By using small experiments, you can test out new ideas or digital products to see if they align with what your customers want. If the experiment works, then you have more info on how to implement it into something bigger and better, which saves both time and money in the long run!

16 – they drive digital strategy from a business perspective, not just IT

Technology is the enabler of digital transformation, not its driver. Organizations need to focus on transforming their business model and approach to meet customer demands rather than just focusing on the technology. This means they should be less reliant on big digital projects and more focused on building a digital business that is agile and able to change with the times.

17 – they use data as part of their decision-making process: not just paying lip service to the idea

Insurance providers need to take a data-driven approach if they want to truly become digital organizations. Digital transformation is all about having a deep understanding of customer behavior and making use of big data analytics to inform decisions that can impact your business for both the now and future.

18 – they optimize their technology portfolio: it's not just about being digital, it's about choosing the right digital strategy for your business.

Insurance providers need to understand that they shouldn't adopt new digital technologies if they don't help them achieve their goals; this means having a digital technology evaluation process in place is essential. Digitizing your insurance portfolio doesn't just mean using digital tools but using the right ones that work for you and your customers.

19 – they continuously improve: by focusing on continuous improvement, organizations can take a holistic approach to digital transformation instead of going it alone.

Digital transformation can't happen overnight if you want it to be successful. To make the process easier, insurers should focus on taking a continuous improvement approach which requires building an organizational culture focused on collaboration. This means you should share lessons learned with other organizations, keep an open mind to ideas from outside sources, and be willing to work together to make digital transformation success.

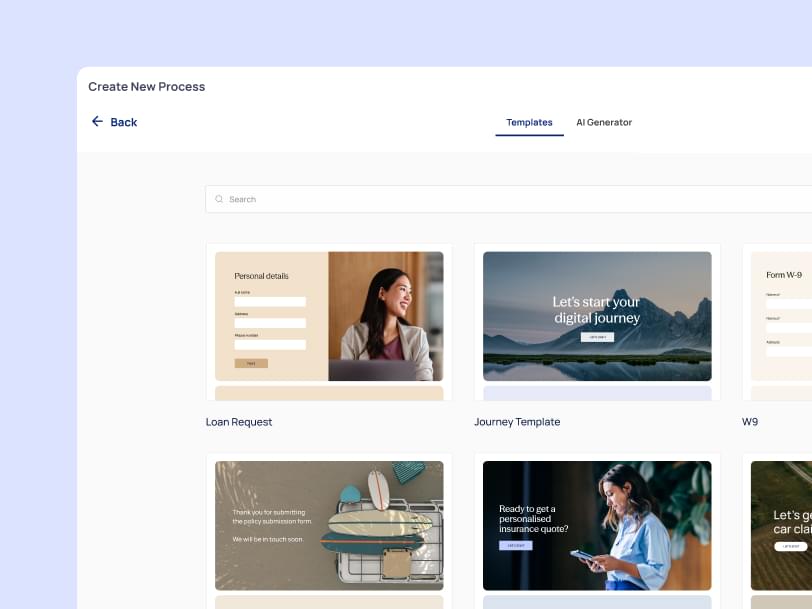

20 – they embrace decentralized decision-making and empower non-technical users to deliver value without relying exclusively on IT teams.

End-to-end digital transformation requires empowering the people closest to the problem with the best skills to solve it, rather than delegating decisions to managers or executives who are only looking at part of the business. Insurance providers need to decentralize their decision-making process by allowing employees to use their expertise and insights on various digital projects, which will make their processes more efficient.

The bottom line

Digital transformation requires much more than just having a digital strategy but actually making the right decisions in how you approach it at every step of the way.

Digital maturity is not about focusing on the technology, but understanding how it works for your business and gaining insights from your customers to make better decisions.

If you want to transform your insurance business into a digitally mature organization, you should focus on data-driven decision-making and building an ecosystem of digital tools that evolve with your business.

You can't go it alone either; to accelerate the pace of digital transformation in insurance, organizations need to build collaborative networks with startups and technology vendors which can share lessons learned and best practices.

All of this is possible if you can follow a more customer-centric philosophy. By taking a more user-centric approach, insurance providers can truly deliver the best digital experience for their customers – which means creating real value and building long-term relationships.