The world is changing. Naturally, the way we buy and sell insurance products is changing too. Increasingly, insurance is becoming a product that is bought rather than a product that is sold.

Historically, there was a significant information asymmetry between the insurance company and its customers. Gradually, this asymmetry is disappearing as new; innovative insurance solutions are introduced to the market, and the ways consumers can get informed grow exponentially.

Digital transformation solutions enable customers to research insurance products independently without relying on brokers and agents as exclusive sources of information as often has been in the past.

Customers are increasingly knowledgeable about risk, product offerings, and their options.

Today, insurers have to compete with the very best customer experience across all industries, and insurance is increasingly becoming a product that is bought instead of sold.

The importance of customer experience

In the digital world, consumers have more power than ever before. The information flows have been democratized, with consumers having access to customer feedback, reviews, and detailed comparison sites at their fingertips. Brand loyalty is a thing of the past, with consumers switching providers often and willing to shift to a new provider if their offer seems compelling.

Insurance is a complex industry, and the simplicity of the overall customer experience is a key attraction driver. Simplicity is an essential driver for customer engagement, and insurers are increasingly taking the lead from digital transformation in financial services and banking.

Customer experience is increasingly becoming a critical competitive advantage and differentiator for insurers looking to attract new customers and retain existing ones.

Customer journey as a growth and retention engine

According to Mckinsey, insurance companies that offer the best-in-class customer experience are 80% more likely to retain customers. Since the cost of acquiring a new customer is five times higher than the cost of maintaining a customer, it makes sense to focus on maintaining high levels of customer satisfaction.

Many insurers still view every discrete customer interaction, from visiting the website to downloading an app to a call with an agent, as a discrete event. Customers increasingly see these steps as a part of a journey that they embark on to protect themselves and their families from an accident or another claim event.

Improving customer satisfaction across the entire journey is an essential contributor to growth. In this context, digital customer journeys offer a world of opportunities for insurers to provide a streamlined and consistent customer experience and deliver high levels of satisfaction.

What makes a great customer experience?

KPMG Nunwood has identified Six Pillars of customer experience that all needs to come together across the entire customer journey to deliver outstanding experience:

- Empathy - Great customer experience stems from an understanding of the customers, their fundamental needs, and motivations

- Personalization - In the age of data, consumers expect organizations to use the data they have collected to improve their experience and offer personalized, tailor-made solutions

- Time & Effort - Consumers expect fast delivery and a seamless experience when purchasing insurance products

- Expectations - Delivering on the brand promise is not optional, as is managing customer expectations. The age of overpromising and under-delivering is over, as this is a sure way to lose customers

- Resolution - In any business, problems will inevitably arise. The quality and speed of response to any issues is a crucial factor contributing to the quality of customer experience

- Integrity - Especially millennial consumers prioritize organizations that align with their moral code and standards and care about the causes that the consumers care about.

McKinsey’s research identified five qualities that were key to driving customer satisfaction in insurance:

- Employee courtesy

- Ease of communicating with the insurer

- Employee knowledge and professionalism

- Transparency and ease of the process

- The speed of the claim settlement

Surprisingly, the settlement amount ranked only 12th in order of importance by customers, behind the ease of tracking claim status and flexibility in scheduling the appraisal.

While employee training and customer culture are essential, all these parameters can be enhanced with digital technology to streamline communications, remove inefficiencies, and speed up processes.

Shortcomings of customer experience in insurance

Many insurers fail to deliver a great customer experience because shifting from a business focusing mainly on selling policies rather than providing outstanding expertise is not easy to do. It is no longer enough to have superior products. The customer’s experience from the first interaction to filing a claim must be outstanding at every step of the way.

Increasing customer expectations to deliver a perfect experience throughout the entire journey can be met by aligning the organization to achieve that goal.

Traditionally insurers had minimal interactions with customers, relying on broker/agent models for maintaining customer relationships. Today, insurers increasingly take back control over the customer journey.

However, many processes in insurance are still managed through manual, outdated, and paper-based processes. From customer onboarding to policy renewals or claims processing - the amount of manual paperwork and document processing involved is astounding.

Such outdated ways of doing things damage customer experience at every customer interaction where they happen. It is imperative to move away from this obsolete way of doing things and into a digital world where customers can initiate any action, get service and make changes in their policies with a click of a button.

Agility is key at improving customer experience in insurance

The very first step is removing manual, paper- or call-based processes from the equation. Nobody likes paperwork, and insurers who are capable of transforming those clunky experiences into seamless digital customer journeys quickly gain a competitive advantage.

Insurers who are behind on digital transformation solutions must catch up to digital newcomers quickly if they are to retain their customer base and attract new policy sales.

But customer experience is not something that can be done once and forgotten about. The key is in continuous improvement. Radically redesigning customer journeys from start to finish and transitioning to digital journeys is the first step. But to maintain high levels of satisfaction, it is imperative to move fast, test new technologies and approaches, and improve on an ongoing basis.

Monitoring KPIs and optimizing processes to improve customer experience is key. Simply creating a digital journey once and forgetting about it will not cut it in 2021 and beyond.

Customers are no longer willing to tolerate less than ideal experiences. And to transition from manual and slow processes towards digital experiences, insurers must move quickly every step of the way, gather data, test, and optimize.

No-code tools empower agility and ongoing customer experience improvements

The digital world is made of code. Traditionally, insurers relied on internal IT departments and outsourced consulting firms to power their digital transformation initiatives. But to push agility to the required levels today, a new approach is quickly gaining ground.

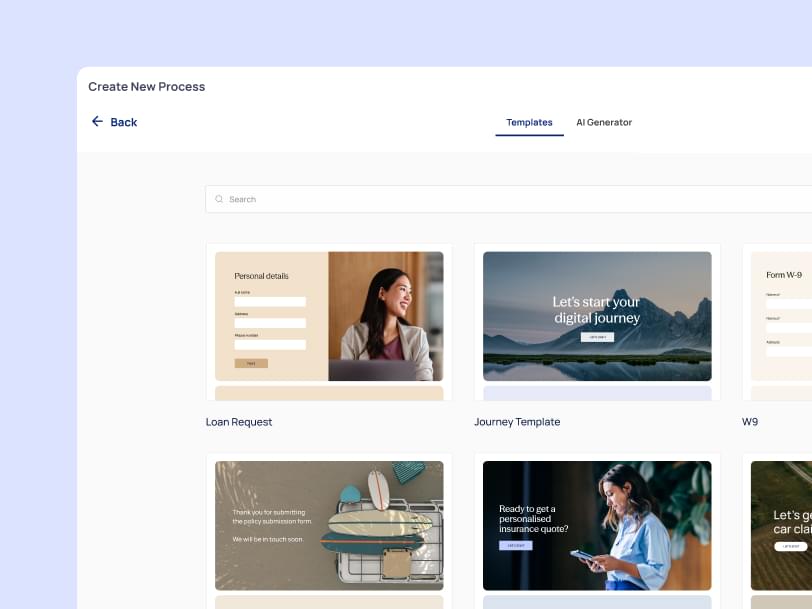

Low-code/no-code platforms and digital transformation solutions empower business users to quickly spin up apps and products through Drag and Drop visual builders. A no-code platform amplifies existing resources and empowers employees to create and update digital customer journeys quickly, test, and improve without having to wait for IT departments.

By shifting gears, insurers can quickly solve issues with customer journeys, address customer problems, and deliver an outstanding experience every step of the way.