Intelligent automation has tremendous potential to help insurers grow revenues and reinvent their operations. However, automation cannot be simply viewed as a means to automate tasks and processes. Instead, it should be seen as an opportunity to provide new and innovative products and services that meet customers' needs in an ever-changing landscape.

Intelligent automation in insurance as a core growth driver

The insurance industry is at a tipping point. Insurers are starting to see the potential for automation to help them improve efficiency and grow revenue.

According to Gartner, 53 percent of insurance firms are currently experimenting with or already employing digital process automation technologies. At the same time, a further 27% intend to do so in the medium-to-long term.

The insurance industry is under pressure to find new sources of growth as traditional sources of revenue come under pressure. Intelligent automation can help insurers tap into new sources of revenue by providing new products and services that cater to changing customer needs.

Automation has the potential to provide significant growth opportunities for insurers. To take advantage of these opportunities, insurers need to shift their focus from task and process automation to intelligent automation that will enable them to reinvent their operations and grow their revenues.

Areas that can benefit from intelligent automation in insurance

There are many areas where insurers can benefit from automation, including underwriting, claims processing, and customer service.

Underwriting

Underwriting is one area where automation can help insurers improve efficiency. Automation can help to speed up the underwriting process by automating repetitive tasks such as data entry and claims processing. In addition, automation can help to improve the accuracy of underwriting decisions by providing better data and analytics.

Claims processing

Claims processing is another area where intelligent automation can help insurers improve efficiency. Automation can help to speed up the claims processing process by automating repetitive tasks such as data entry and claims processing. In addition, automation can help to improve the accuracy of claims decisions by providing better data and analytics.

Customer service

Customer service is another area where automation can help insurers improve efficiency. Automation can help to speed up the customer service process by automating repetitive tasks such as data entry and customer service. In addition, intelligent automation can help to improve the quality of customer service by providing better data and analytics.

Automation in insurance maturity stages

Task automation

Task and process automation have been the focus of many insurers in recent years. This type of automation involves using technology to automate simple tasks and processes that are currently performed manually.

Process automation

Process automation is the next level of automation in insurance. This type of automation involves using technology to automate more complex processes and workflows that involve multiple steps and systems.

Orchestration across functions

This type of automation involves using technology to automate and manage the end-to-end policy lifecycle across multiple functions and channels.

Business operation creation/reinvention

The highest level of automation in insurance is business operation creation/reinvention. This type of automation involves using technology to create entirely new businesses or completely reinvent existing businesses.

By shifting their focus from task and process automation to intelligent automation focused on business operation creation/reinvention, insurers can tap into new sources of growth and create significant value for their customers.

Challenges of insurance automation

However, despite the many potential benefits of automation, some challenges still need to be addressed before it can truly take off in the insurance sector.

Many insurance organizations are struggling to scale automation beyond initial use cases. Most initiatives focus on data input and replication of human tasks rather than supporting a reinvention or recalibration of processes.

Focus on task and process automation

One of the biggest challenges facing insurance automation is focusing on task and process automation instead of business operation creation/reinvention.

As a result, the initial automation deployments focus on replicating human data entry tasks, tackling the high-volume, high-error-rate use cases. While adoption of automation to augment work in more skilled roles (such as claims administrators and underwriters) remains in its infancy.

Lack of automation maturity

Another challenge facing automation in insurance is the lack of automation maturity. Many organizations are still in the early stages of automation adoption, with most initiatives focused on data input and replication of human tasks.

Only a small minority of insurers have progressed to more complex use cases such as fraud detection, customer segmentation, and risk assessment.

This lack of maturity is hindering the ability of insurers to scale automation beyond initial use cases and realize the full potential of the technology.

Data quality and governance issues

A third challenge facing automation in insurance is data quality and governance. For automation to be successful, insurers need high-quality data that are well-governed and compliant with regulations.

However, many insurers are struggling with data quality and governance issues, preventing them from leveraging automation to its full potential.

Lack of standardization

One is the lack of standardization around data and processes. This makes it difficult for different systems to communicate with each other and makes it hard to compare data from various sources.

Integration

Another challenge that needs to be addressed is the integration of automation into existing systems and processes. Many insurers have legacy systems that are incompatible with newer automation technologies, making it challenging to integrate automation into existing operations.

Cost

Another challenge is the cost of automation. Automation can be expensive, and many insurers are hesitant to invest in it because of the upfront costs.

Culture change

One final challenge that needs to be addressed is the culture change that automation requires. Automation can be disruptive, requiring employees to learn new skills, which can be a challenge for some insurers.

Despite these challenges, automation in insurance is still an up-and-coming area with significant growth potential. Insurers that can embrace automation and use it to reinvent their operations will be the winners.

Insurers willing to embrace change have the opportunity to drive greater adoption and scale by expanding their solutions from initiatives that are solely focused on data entry to driving more significant insights, improving customer engagement, and developing new services.

The future of automation in insurance

The industry as a whole is maturing its automation adoption.

Many insurance providers have moved past simple task automation to focus on complete end-to-end processes like new business and claims processing. They're now at the point where they need to create knowledge, skills, and structures to automate across the company, necessitating the need for higher-level positions.

Insurers are also searching for places to deploy automation in business units such as actuarial, finance, HR, and compliance. Insurers aim to reach the level of experience and capabilities where they may rethink processes as driven by technological capabilities rather than human-driven activities.

The future of automation in insurance is bright. Insurers who embrace intelligent automation and use it to reinvent their operations and grow their revenues will win the new insurance landscape.

Automation can help insurers improve efficiency and accuracy, freeing employees for more strategic tasks. It can also help them reinvent their operations, making them more customer-centric and data-driven. And it can open up new revenue opportunities by providing insights that enable insurers better assess risk and identify new customers.

The way forward: automating customer data collection

As we can see from above, one of the biggest obstacles to automation is the data quality fed into the internal systems.

Automation depends on the quality of the data it's given. If the data is inaccurate, all the workflows automated downstream will be inefficient.

Many insurers still rely on customer data collected manually and in an unstandardized way, which is error-prone and time-consuming. PDF forms and stand-alone web forms are still prevalent for collecting customer data.

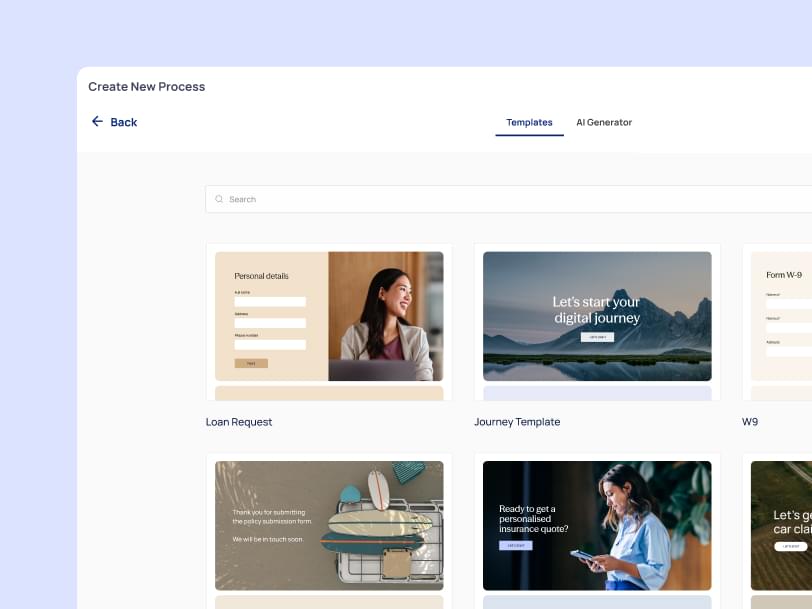

This needs to change if insurers want to benefit from automation fully. There are already solutions that can help insurers automate the data collection process. These solutions use intelligent web forms integrated with the insurer's back-end systems. This way, data is collected in a standardized way, validated at the point of entry, and is automatically transferred to the right places in the back-end without the need for manual data entry.

By digitizing the data collection process, insurers can have clean, accurate data. This would allow insurers to accurately assess risk, make better decisions, and automate more complex use cases, unlocking the full potential of automation in insurance.