The quote-to-bind ratio is a crucial metric in the property and casualty insurance industry, as it measures the rate at which customers move from obtaining a quote to purchasing a policy. Improving this ratio is essential for insurers looking to increase sales, enhance customer satisfaction, and streamline operations.

In recent years, digital data collection has emerged as a game-changer in this regard, empowering P&C insurers to streamline and optimize the entire policy purchase experience.

Let’s explore the ways digital data collection contributes to improving the quote-to-bind ratio in the P&C insurance sector.

Instant Data Access & Integrations

Digital data collection enables insurers to streamline access to customer information and risk factors. This immediacy not only accelerates the quoting process but enables pre-filling of customer data from various sources, such as previous policies, public records, or previously filled-in forms. The result is a faster, more efficient quoting process that encourages customers to move forward with purchasing a policy.

Real-Time Collaboration and Communication

Digital data collection allows for seamless collaboration and communication between various departments within an insurance company, such as underwriting, claims, and customer service. By breaking down silos and enabling real-time information sharing, insurers can process quote requests more efficiently and quickly respond to customer inquiries. This streamlined communication contributes to a smoother quote-to-bind process, increasing customer satisfaction and, ultimately, policy sales.

Advanced Analytics and Risk Assessment

Digital data collection systems harness advanced analytics and machine learning algorithms to assess risk profiles more accurately and efficiently. By leveraging data-driven insights, insurers can calculate premiums and generate quotes more quickly, improving the quote-to-bind ratio. Furthermore, these advanced analytics help insurers identify the most profitable customers, enabling them to focus their efforts on high-conversion prospects.

Integration with Third-Party Data Sources

Digital data collection allows insurers to access and integrate information from external sources, such as credit reports, driving records, or property assessments, in real-time. This additional data helps create a more accurate risk profile, streamlining the quote generation process, and ensuring that customers receive quotes tailored to their unique needs.

Customization and Personalization

Digital data collection allows for the creation of tailored insurance products based on individual customer needs and preferences. Insurers can generate personalized quotes more quickly by leveraging customer data and preferences collected through digital channels. This level of customization and personalization enhances the customer experience and increases the likelihood of policy purchases, thus improving the quote-to-bind ratio.

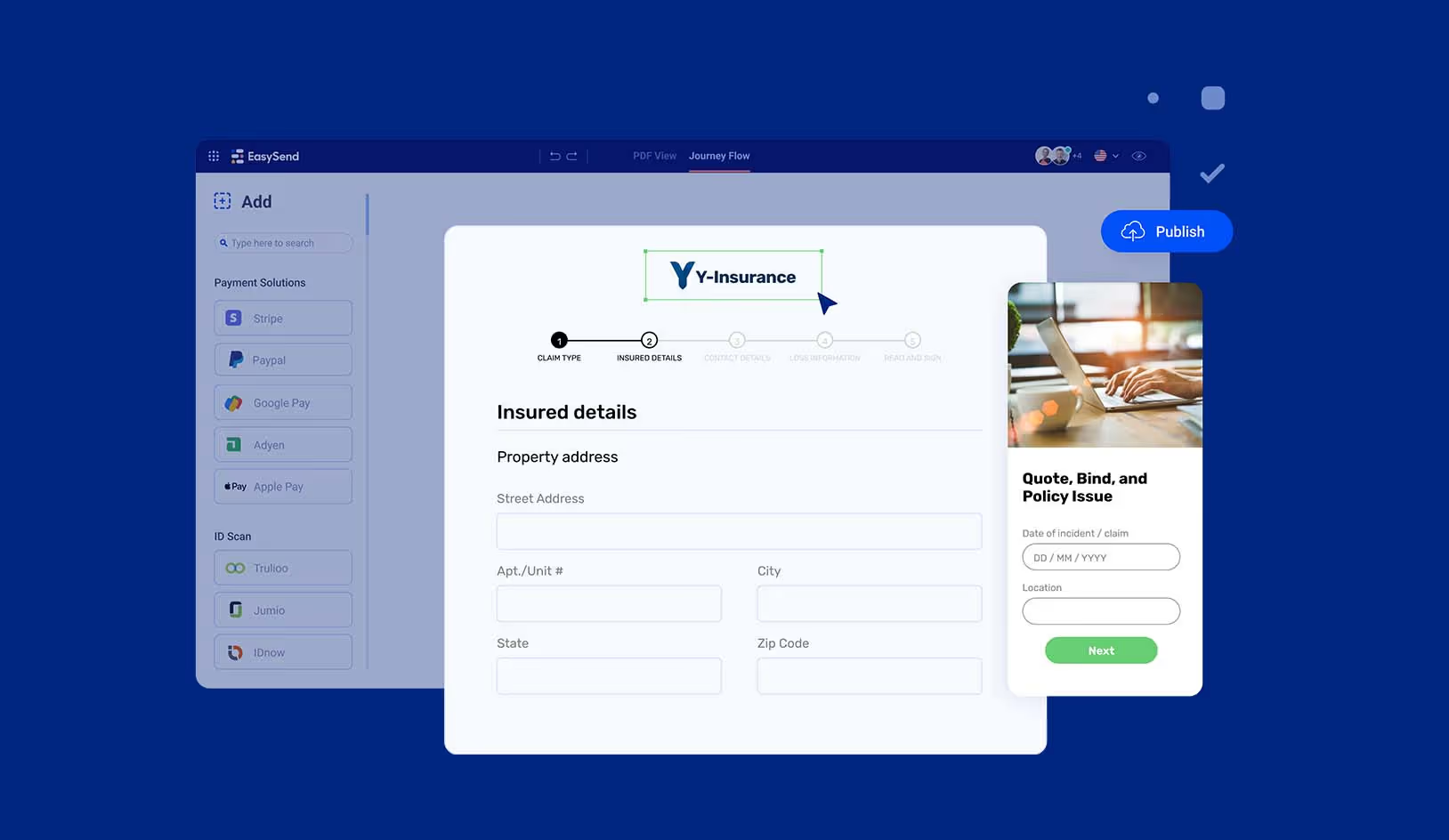

Enhanced User Experience and Self-Service

Digital data collection enables customers to request quotes through user-friendly online platforms or mobile apps. These digital channels guide customers through the process step-by-step, ensuring they provide all necessary information in a clear and efficient manner.

This enhanced user experience contributes to faster quote generation and a higher likelihood of customers proceeding to bind their policies. Additionally, self-service platforms empower customers to manage their policies and access essential information, further driving the quote-to-bind ratio upward.

Continuous Process Improvement and Optimization

Digital data collection offers insurers access to valuable insights into customer behavior, preferences, and feedback throughout the quoting and binding process. This wealth of data enables insurers to identify bottlenecks, inefficiencies, or areas for improvement within their workflows.

By continuously optimizing their processes based on data-driven insights, insurers can further enhance the customer experience, reduce quote generation time, and increase the likelihood of customers binding their policies. This continuous improvement approach drives the quote-to-bind ratio upward and fosters a culture of innovation and customer-centricity within the organization.

Personalized and Targeted Marketing

Digital data collection equips insurers with a wealth of information about their customers' preferences, interests, and demographic details. By leveraging this data, insurers can develop targeted and personalized marketing campaigns to engage potential clients more effectively. By offering customers insurance solutions that are tailored to their specific needs and interests, insurers are more likely to convert prospects into policyholders, ultimately improving the quote-to-bind ratio.

Enhanced Customer Support and Education

Digital data collection allows insurers to better understand customer needs and preferences. By using this information, insurers can provide more comprehensive and personalized support throughout the quote and bind process. Insurers can develop educational resources and offer guidance to help customers better understand their coverage options and make more informed decisions. When customers feel well-informed and supported, they are more likely to trust the insurer and move forward with binding their policy.

The bottom line

Digital data collection has proven to be a transformative force in the P&C insurance industry. By streamlining data access, leveraging advanced analytics, integrating with third-party data sources, and enhancing the customer experience, digital data collection enables insurers to significantly improve their quote-to-bind ratios. Embracing these innovative approaches will not only drive sales growth and profitability but also position insurers at the forefront of an increasingly competitive market.