As the world continues to advance at an unprecedented pace, industries across the spectrum are leveraging digital technologies to revolutionize their operations. The insurance industry, traditionally seen as a conservative sector, is no exception.

Insurers are now reshaping the customer experience landscape, embracing digital innovations that promise to streamline processes, enhance service delivery, and ultimately, redefine the customer journey. Let's take a look at how these digital transformations are shaping the future of customer experience in insurance.

1. Personalization through Big Data and AI

With the exponential growth in data generation, insurers now have a wealth of information at their disposal.

Big data technologies enable the industry to collect, analyze, and interpret this data to glean valuable insights about customer behavior, needs, and preferences. The application of Artificial Intelligence (AI) and Machine Learning (ML) technologies supercharges these efforts, allowing for highly personalized insurance products.

AI algorithms can predict customer behavior, identify patterns, and deliver personalized recommendations. This leads to an enhanced customer experience, as policyholders get access to tailored policies that perfectly match their requirements.

2. Seamless experience with robotic process automation (RPA)

Robotic process automation (RPA) has revolutionized the insurance industry by automating repetitive, manual tasks. With RPA tools taking on a significant workload, processes such as claims processing and underwriting have become more efficient, resulting in faster response times. This translates to reduced waiting periods for customers and smoother, more satisfying interactions with insurers.

However, the heavy reliance of RPA on OCR and manual data entry has often led to errors and inefficiencies in the automation process. To address this, the integration of digital data collection with RPA has proven to be a game-changer.

Digital data collection plays a crucial role by enabling insurers to gather and store vast amounts of structured and unstructured data from diverse sources. These sources include online forms, customer portals, social media, and connected devices. The data collected encompasses policyholder information, claims data, risk profiles, and historical trends. RPA tools seamlessly access this digital data, ensuring faster and more accurate task processing.

The synergy between digital data collection and RPA enhances the insurance industry in multiple ways:

- Input for Automation: Data collection serves as the necessary input for RPA to automate tasks effectively. RPA relies on the accessibility and real-time availability of data provided by digital collection methods.

- Seamless Integration: RPA seamlessly integrates with data collection systems, allowing for validation and reconciliation of data from diverse sources. This integration ensures data accuracy and consistency throughout the automation process.

- Real-Time Processing: Real-time data processing empowers RPA bots to perform timely actions and responses. By continuously monitoring and processing incoming data, RPA can initiate notifications, alerts, and other relevant actions promptly.

- Elimination of Manual Data Entry: RPA eliminates the need for manual data entry by extracting and populating pertinent information from digital documents. This eliminates errors and significantly reduces processing time.

- Data-driven Decision Making: The combination of RPA and data collection supports data-driven decision making. RPA tools analyze vast datasets, identify patterns, and generate reports and recommendations to enhance operational efficiency and informed decision making.

The integration of RPA and digital data collection brings remarkable benefits to the insurance industry, resulting in enhanced accuracy, speed, and an overall better customer experience. By automating repetitive tasks and leveraging real-time data, insurers can achieve improved efficiency and deliver more satisfying interactions for policyholders.

3. Enhanced claims management with IoT and AI

The Internet of Things (IoT) and AI are transforming the claims process, a historically pain point in customer experience. Smart devices like connected cars, wearables, and smart home devices can provide real-time data about accidents, health conditions, or damages to insured properties. Insurers can leverage this data to streamline the claims process, assess damages accurately, and expedite settlements.

4. 24/7 availability through chatbots and virtual assistants

Digital virtual assistants and chatbots, empowered by AI, are becoming increasingly popular in insurance. They offer round-the-clock service, providing instant responses to queries, assisting with policy purchases, and even guiding customers through claims processes. This 24/7 availability improves accessibility and responsiveness, further enhancing the customer experience.

5. Blockchain for enhanced trust and security

While blockchain technology is most famously associated with cryptocurrencies, its potential applications in insurance are enormous. It provides a transparent, decentralized ledger system that can verify transactions, authenticate identities, and reduce fraud. This enhances trust between insurers and policyholders, improves data security, and expedites contract and claims processing.

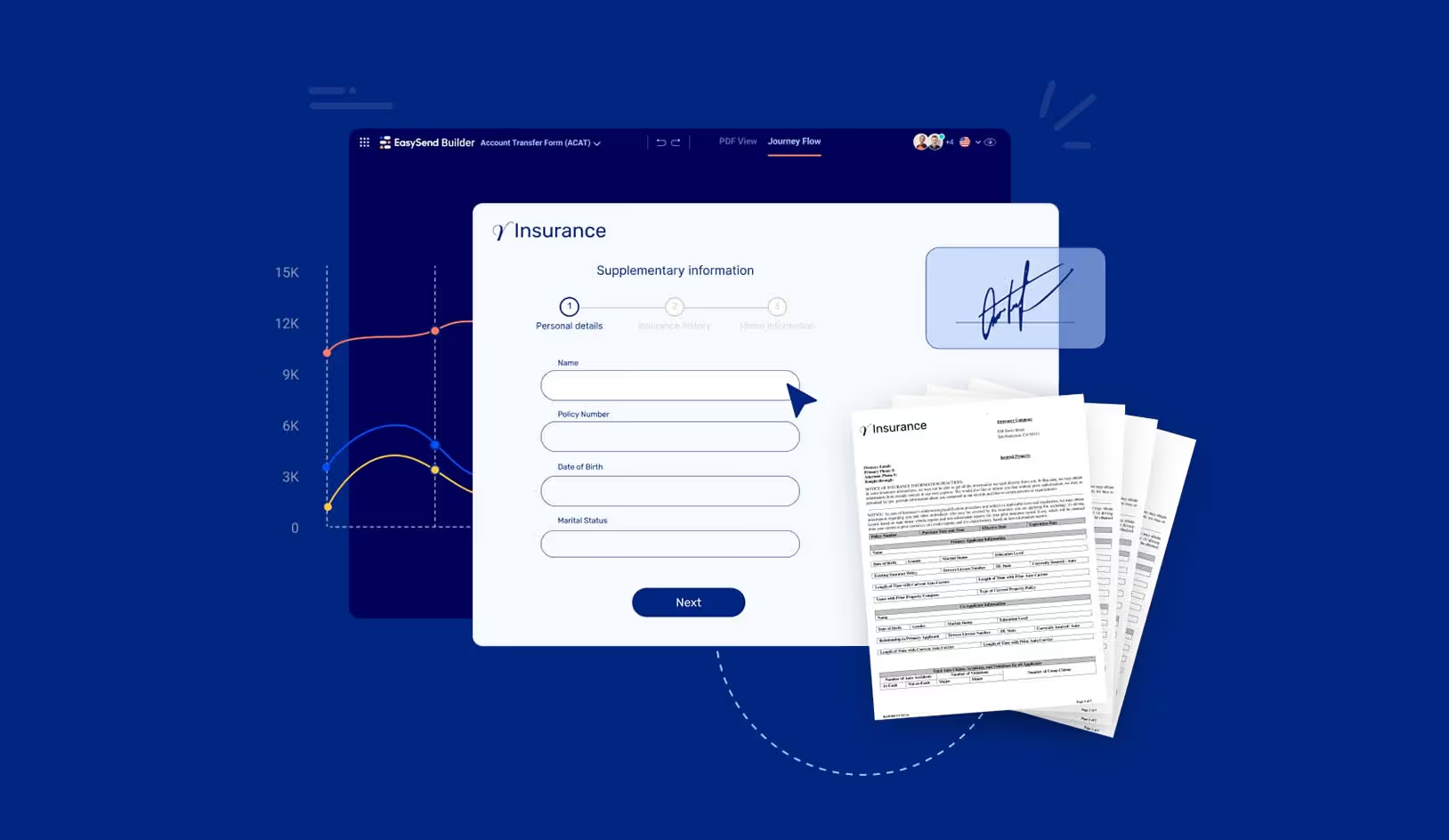

6. Digital-first insurance platforms

As customers grow more tech-savvy, there's a surge in demand for complete digital solutions. Digital-first insurance platforms are on the rise, providing intuitive, user-friendly platforms for customers to purchase policies, submit claims, and manage their insurance from anywhere, at any time.

These innovations are not just about improving efficiency and reducing costs for insurers, but about fundamentally enhancing customer experience. The integration of digital technologies in insurance holds enormous potential to deliver more value, more convenience, and more personalized services to customers.

The insurance industry of the future is here. And it is digital, personalized, and customer-centric. As insurers continue to navigate their digital transformation journeys, customers stand to benefit from the industry's progressive strides, ushering in a new era of insurance experience defined by innovation, simplicity, and satisfaction.