Document collection often resembles a frustrating game of hide-and-seek. Clients scramble to submit paperwork, while businesses struggle to manage the influx efficiently. But what if there was a smoother way to navigate this maze?

Meet Sarah, a diligent homeowner who recently experienced water damage to her property. Concerned about potential costs, she promptly files a claim with her insurance provider, hoping for a swift resolution. Little does she know, her journey through the insurance process is about to take an unexpected turn.

After filing her claim online and providing all the necessary details, Sarah receives a follow-up email from her insurance company requesting additional documentation to support her claim. Eager to expedite the process, she diligently gathers the requested paperwork, including photos of the damage and repair estimates, and sends them off via email.

Days pass, and Sarah hears nothing but radio silence from her insurance provider. Concerned about the status of her claim, she reaches out to inquire about the next steps. To her dismay, she discovers that her documents were never received due to an oversight in the email chain.

Frantic and frustrated, Sarah re-sends the missing documents, this time ensuring they're labeled clearly and attached securely. However, her troubles are far from over. Despite her best efforts, the documents still fail to reach the right hands, lost amidst the sea of emails flooding the insurance company's inbox.

Weeks turn into months, and Sarah's patience wears thin as she continues to navigate the bureaucratic maze of missing documents and communication breakdowns. Meanwhile, the damage to her property remains unresolved, exacerbating her stress and financial strain.

The quest for missing documents can often feel like a never-ending saga, characterized by a frustrating dance of back-and-forth communication. Here's a closer examination of how missing documents are typically handled today and the myriad problems that arise from this antiquated approach

Endless Email Exchanges

Picture this: a client submits a claim or application, only to receive a follow-up email requesting additional documents. They dutifully respond with the requested files, only to be met with another email asking for further clarification or additional paperwork. This cycle repeats ad nauseam, resulting in a seemingly endless stream of emails cluttering both the client's and the provider's inboxes.

Attachment Anxiety

Attachments are the lifeblood of document exchange. However, relying on email attachments for document submissions can quickly become a logistical nightmare. Files may be too large to send via email, leading to errors or rejections. Moreover, there's always the risk that attachments will get lost in transit or buried within lengthy email threads, making them difficult to track and manage.

In addition, there are privacy and security risks that need to be taken into account. Attachments transmitted via email are vulnerable to interception or unauthorized access, posing significant privacy and security risks for sensitive documents. This leaves individuals and organizations exposed to potential data breaches or privacy violations.

Confusion and Miscommunication

As the email chain grows longer and more convoluted, confusion and miscommunication inevitably rear their ugly heads. Clients may struggle to keep track of which documents have been requested and which ones they've already submitted. Meanwhile, insurance and financial service providers grapple with deciphering cryptic file names and piecing together fragmented information scattered across multiple emails.

Lack of Integration and Automation

Finally, the lack of integration and automation in traditional document collection methods exacerbates the challenges faced by insurance and financial service providers. Without a streamlined system in place, businesses are forced to manually extract, organize, and store incoming documents, further adding to their workload and reducing efficiency.

Time Wasted, Opportunities Lost

Ultimately, the fallout from inefficient document collection processes extends far beyond mere inconvenience. Delays in obtaining missing documents can grind critical business operations to a halt, leading to missed deadlines, lost revenue opportunities, and frustrated clients. Meanwhile, valuable time and resources are squandered on manual administrative tasks, diverting attention away from more strategic endeavors.

The EasySend Solution

Current approach to handling missing documents in insurance and financial services is a recipe for chaos and frustration. It's clear that a more streamlined and efficient solution is needed to break free from the cycle of back-and-forth communication and usher in a new era of seamless document collection. That's where EasySend steps in to revolutionize the process.

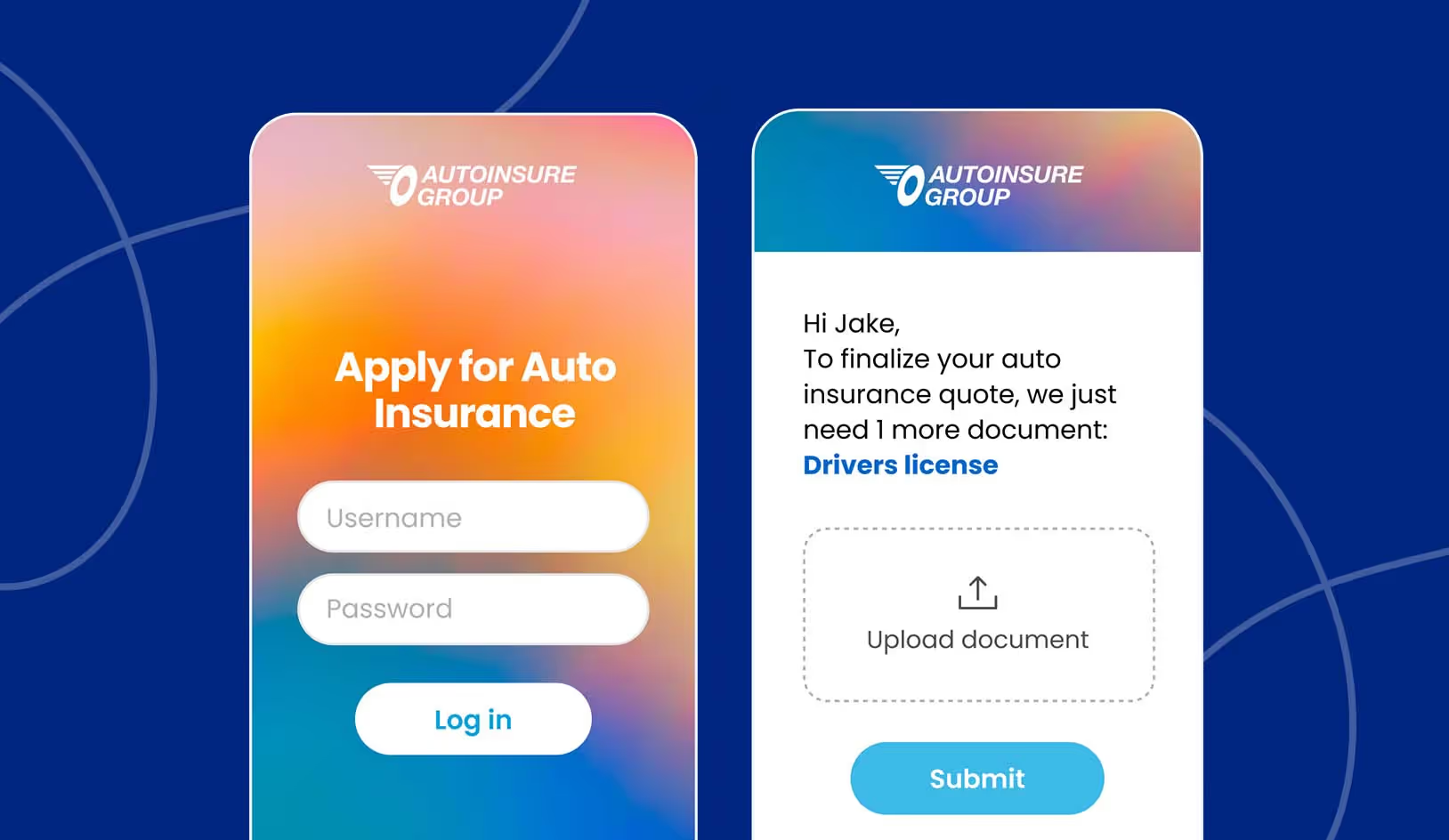

Enter EasySend's dynamic customer interactions. Our innovative platform offers a seamless alternative to traditional document collection methods. Here's how we do it differently:

- Ready-made Templates: Say goodbye to lengthy development processes. Our templates are ready to use out of the box, saving you time and resources.

- Enhanced Security: With features like OTP authentication, rest assured that your data is safe and sound throughout the transfer process.

- Integration and Automation: Seamlessly integrate document collection into your existing workflow, eliminating manual handling and reducing the risk of errors.

- Versatile File Support: Whether it's PDFs, JPGs, or Word documents, EasySend supports a variety of file formats for maximum flexibility.

- White Labeling: Customize the platform to reflect your brand identity, ensuring a seamless and professional experience for your clients.

- Multi-Channel Initiatives: Reach clients where they are by initiating document collection across various channels, from email to SMS.

- Personalization: Tailor the experience to suit your clients' needs, enhancing engagement and satisfaction.

EasySend provides a simple yet powerful solution that streamlines the customer process with minimal effort. By eliminating unnecessary manual handling and documentation delays, businesses can unlock newfound efficiency and enhance client satisfaction.

Imagine a world where paperwork no longer dictates the pace of business. With EasySend, this vision becomes a reality. Our platform empowers businesses to eliminate excessive manual handling, making missing document collection a seamless part of the digital flow.