It's no secret that customer experience is the new competitive battleground in financial services as the industry is rapidly shifting from traditional to digital, customer-centric business models.

Financial institutions must transform their digital experiences quickly

The shift in the financial industry has been driven by technology, which has made it easier for customers to access their money and make transactions online. In order to keep up with customer demands, financial services organizations must transition from a traditional mindset and adopt a customer-centric approach.

Customer expectations have changed in parallel with technology advancement. Customers now expect to bank or purchase insurance policies from anywhere and at any time - not just when they are in the office or on their desktop. If financial service providers fail to keep up with customer expectations, their customers may start looking for other alternatives.

Companies need to adapt quickly as new technologies emerge, or they risk being left behind in the digital age. Today, an agile digital transformation is a must. Banks, insurance carriers, and financial service organizations need to heavily invest in cutting digital customer journeys supported by unified analytics if they want to be relevant for their customers in 2021.

Digital transformation is as difficult as ever

However, according to a recent report by McKinsey, the challenge to adapt to the new digital reality is especially tough for financial organizations because the legacy systems and core banking and insurance applications are difficult to reconcile with the demands for cutting-edge customer experiences. Legacy systems are slowing financial institutions down in an age where digitalization is taking over everything.

Financial institutions have invested heavily in new technologies. Still, these investments can lead them down a slippery slope as adopting new innovations often adds complexity, creating systems that are siloed, difficult to manage, and therefore are challenging to scale.

In the following article, we will explore four areas:

- How digital customer journeys can help financial services meet customer expectations

- The importance of a platform to manage the digital customer journeys

- The need for unified analytics to optimize the digital experience

- The need for a no-code platform to digitize journeys

How digital customer journeys can help financial services meet customer expectations

Digital customer journeys help financial services meet customer expectations. There is an important difference between digital interactions and digital customer journeys. Unlike a one-off digital interaction, a digital journey empowers customers to interact with organizations in multiple digital contexts: websites, social media platforms, and chat apps such as WhatsApp or Facebook Messenger, all connected by a unified, seamless experience.

Because of their flexibility and the ability to meet customer expectations, digital customer journeys are the future of digital experience in financial services.

What are digital customer journeys?

Digital customer journeys are omnichannel end-to-end experiences. Digital customer journeys encompass all customer interactions that happen online, and they are the customer's choice of how to interact with financial services.

Digital customer journeys are critical to a seamless, state-of-the-art digital experience in financial services. The hallmarks of digital customer journeys include:

Digital customer journeys are omnichannel

Customers expect an omnichannel experience with seamless integration between channels such as mobile banking apps, ATMs, call centers, branches, etc. Therefore, companies should focus on providing a unified experience across all touchpoints.

Digital customer journeys are personalized

Technology also makes it possible for companies to offer more personalized products and services tailored to each customer's needs and preferences. By utilizing the data that an organization has gathered, it is possible to deliver content and offers that are tailored to each customer.

Digital customer journeys are seamlessly connected to organizational systems

Integrating with internal business systems enhances the customer experience because it allows organizations to optimize internal processes and workflows, utilizing the available internal data to optimize and improve the customer experiences. In addition, it makes it possible to offer laser-focused personalization for each customer.

The importance of a platform for managing digital customer journeys

Without a unified platform to manage the digital customer journeys, organizations are forced to deploy different systems and platforms for each of their channels to run a single customer experience across all touchpoints.

Overhauling the digital experience is not as simple as just coding a single digital journey. The task is to transition every interaction with customers into a digital journey to give customers a seamless experience. Digitizing only one part of the experience is counter-productive since it creates gaps that create friction and churn.

The problem is that creating digital customer journeys demands significant investment in time and resources, not to mention that it is also a complex engineering task to maintain multiple digital customer journeys across an entire organization.

Financial service organizations need solutions for agile digital transformation that are capable of overhauling digital experiences in a matter of weeks. To achieve that, financial enterprises require a platform that offers the rapid creation of digital customer journeys.

The integrated approach to digital journey management allows organizations to transform customer experiences while providing all advantages of the platform: simplified maintenance and management, unified analytics, and simple integration with internal systems.

The solution can come from leveraging the power of no-code platforms designed specifically for digitizing customer journeys across all touchpoints with the company, capable of utilizing the data available internally to optimize and improve the digital experience on an ongoing basis. Integrating with other business systems also enhances the customer experience through optimized business processes.

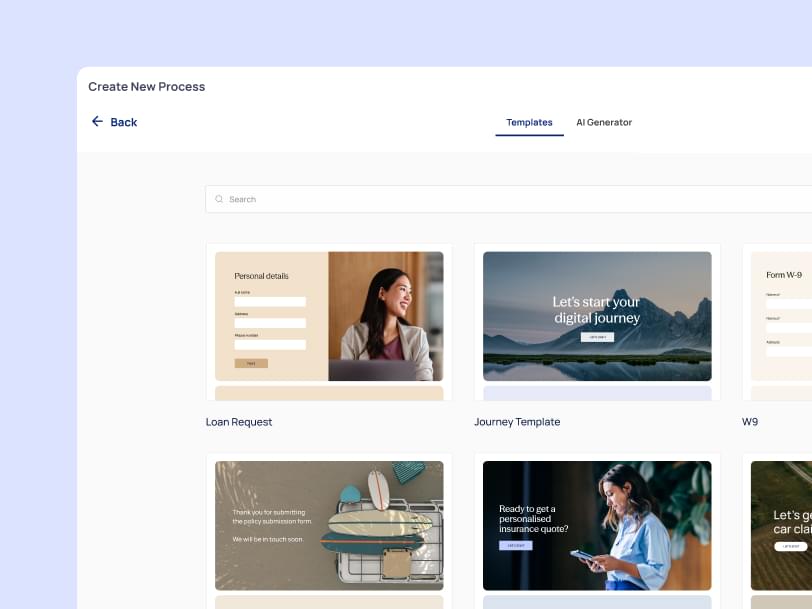

Customized templates with pre-built digital customer journeys are also crucial as they can be deployed as quickly and efficiently as possible while also meeting customer demands.

No-code platforms provide an agile platform that is designed specifically for digitizing customer journeys across every touchpoint.

The need for unified analytics to optimize the digital experience

Data drives every aspect of innovation - it shapes ideas into new products; informs insights about what's working and not working in digital experiences.

As customer experience becomes more and more important, companies need to make sure they're staying up-to-date on the latest trends in user experience to provide a seamless customer journey. This includes utilizing data analytics that can be used for advanced segmentation, optimization, and even predictive modeling of customer interactions.

To keep up with changing customer preferences, customer data must be available in real-time and at scale. A unified analytics system can optimize the digital experience by proactively capturing behavioral data, customer information, and demographic data from customers. A unified analytics system can provide customer data that is more accurate and up-to-date than what is collected in a siloed environment.

The digital journey platform suitable for financial service organizations must include a complete data management and analytics suite. Platforms can offer a unified data management solution for all aspects of the customer journey, from acquisition through onboarding to retention.

Technology also makes it possible for companies to offer more personalized products and services tailored to each customer's needs and preferences. And personalization is key in improving customer outcomes in financial services because it drives engagement and customer satisfaction.

The need for a no-code platform to digitize journeys

If you want to stay competitive, your company needs a customer experience strategy that understands the customer journey in all its complexity. The first step is realizing that the customer's digital journey should be treated as an end-to-end process with channels and touchpoints integrated at every point along with it. The second step is utilizing a platform to create and efficiently manage digital customer journeys at scale rapidly.

Financial organizations must adapt quickly as new technologies emerge, or they risk being left behind in the digital age. A no-code platform such as EasySend will help your organization meet customer expectations by making it easier for employees to create digital customer journeys, improve customer experiences, analyze data from all channels, optimize conversion rates, streamline processes, simplify the delivery of customer service, and more.