The pace of change in the commercial insurance industry is accelerating. Today, business customers want more control over their policy terms, including the ability to customize coverage amounts, deductibles, and exclusions. To keep up with customer demands, commercial lines insurers are shifting their focus away from the conventional "one-size-fits-all" policies and instead are providing customers with customized coverage based on individual requirements.

There also is an increasing demand for self-service and agent-driven portals, which are becoming the standard in personal lines insurance and are bringing with them a need for digital technologies to facilitate these services.

To keep up with market demands, insurers must rely on a whole stack of technologies that can significantly reduce the development time of customer-facing apps and simplify collecting data from customers.

No-code applications in commercial insurance

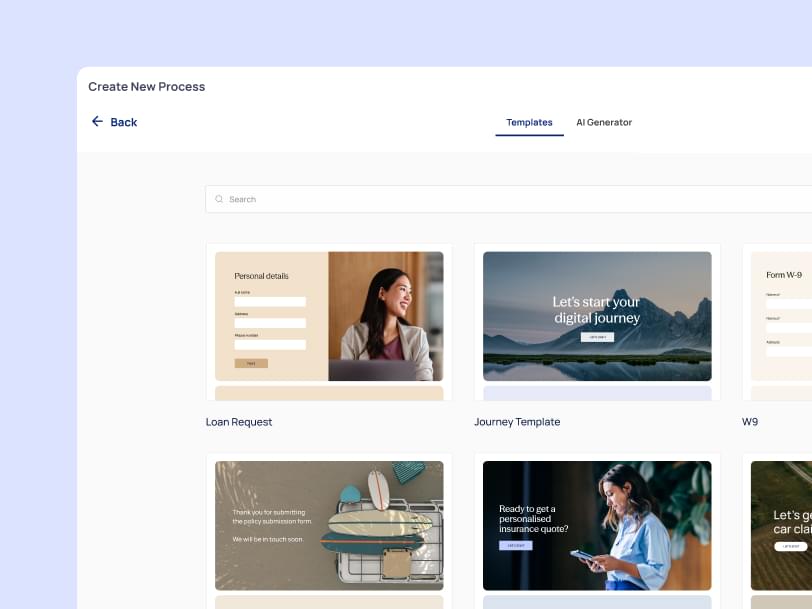

No-code solutions are making it possible for commercial lines insurers to quickly develop powerful customer-facing products. With no-code solutions, insurers can create fully functional customer portals that allow customers to customize coverage amounts, deductibles, and exclusions without wasting time and resources on developing from scratch.

No-code solutions also provide insurers with the power to rapidly update and adjust existing offerings, ensuring that customers are always receiving the best available coverage for their particular circumstances.

What can you build with no-code?

The possibilities with no-code applications in the commercial lines insurance space are virtually endless. Insurers can create anything from automated underwriting systems and customer portals to digital forms and document authentication tools.

- Automated quotes and policy issuance: Insurers can create automated quotation processes that allow customers to quickly receive tailored quotes based on their specific requirements.

- Digital document management systems: Insurers and policyholders can securely exchange, store, track, and manage documents related to their commercial insurance policies via a system accessible from any device.

- Online payment processing: Companies can set up online payment options for customers to pay premiums or make claims with ease.

- Data-driven decision-making tools: Utilizing customer data points such as industry, company size, location, product range etc., insurers can make data-driven decisions regarding pricing and product offerings.

- Interactive customer portals: Insurers can create interactive online customer portals where commercial customers can review policy details, update information, submit claims or ask questions without needing to contact an agent or broker directly.

- Risk analysis/risk assessment tools: Using digital data intake built with no-code platforms combined with predictive analytics models and machine learning techniques, underwriters can quickly identify potential risks associated with certain clientele or industries before issuing policies for them at an acceptable risk level

- Customer service inquiries: Insurers can build self-service customer portals to easily collect and route inbound customer inquiries.

Digital data collection in commercial insurance

In addition to no-code technology, digital data collection is playing an ever more important role in the commercial insurance industry.

Digital data collection simplifies the process of collecting and verifying customer information, making it faster and easier for insurers to provide customers with the products they need. The ability to easily collect data, signatures, and documents from customers is essential for providing the personalized services customers expect.

- Streamline submissions: Digital data collection can simplify the process of submissions, underwriting, document validation, and identity verification processes.

- Accurate and fast quoting: Digital data collection reduces errors and removes the need for manual data entry throughout the policy lifecycle.

- Claims processing: Insurers obtain accurate data during FNOL and claims process and can ensure speedy and accurate processing using customer-submitted digital documents.

- Agent onboarding: Companies can quickly onboard agents and brokers with digital data collection, making the entire process more efficient and reducing paperwork.

- Customer profiling: Insurers are able to create customer profiles based on collected digital data to better understand customer preferences and tailor their product offerings accordingly.

- Fraud detection and prevention: Insurers can use digital data collection to detect anomalies in customer behaviors which could indicate fraudulent behavior before policy issuance or after a claim has been filed.

By collecting customer data digitally, commercial insurers can unlock new insights about their customers and gain a better understanding of their risk profile. This data helps them to price policies accurately and offer customers customized coverage that meets their specific needs.

In addition, digital data collection simplifies conditional workflows, allowing agents to more quickly and accurately collect relevant data depending on customers' industry, state, and risk profiles and seamlessly exchange these data points with the carriers.

Combining No-Code Tools with Digital Data Collection for Better Outcomes

As the demand for more personalized customer service in commercial lines continues to grow, insurers must adopt no-code and digital data collection solutions to stay competitive in the commercial insurance market.

By leveraging no-code technology to build customer portals and digital data collection solutions to gather accurate, up-to-date information on customers, insurers can ensure that their offerings remain relevant in the ever-evolving insurance industry.

- Personalization: Up-to-date customer data enables companies to offer more tailored products and services that are best suited for each individual’s needs without manual intervention from agents or brokers

- Portfolio optimization: Insurers can more accurately assess risks associated with specific portfolios based on up-to-date customer data allowing them better manage capital allocation decisions

- Customer insights & analytics: Digital data collection allows insurers to track customer behaviors, preferences, and trends in real time which provides invaluable insights for making informed decisions about product design, pricing structure, marketing campaigns, etc.

- Risk selection & profiling: Utilizing automated digital data collection also helps companies identify high-risk customers or industries quickly so they can appropriately set premiums and design policies accordingly

By leveraging no-code technology and digital data collection, commercial insurers can unlock new insights about their customers and gain a better understanding of their risk profile. Ultimately these strategies help companies stay competitive in the ever-evolving insurance industry while providing superior customer service experiences for policyholders.