Digital technologies and tools have created new opportunities for insurance agents and brokers to effectively and efficiently manage relationships with their customers.

The results of the 2022 Independent Insurance Agent Survey were released on February 9 by Professional Insurance Agents (PIA). The survey collected data from more than 5,000 independent insurance agents across the United States and was conducted to help PIA gain a better understanding of trends in the industry.

The survey found that independent insurance agents are increasingly turning to technology, such as digital quoting tools, telematics and robotics, to provide better customer experiences. Additionally, more than half of respondents said they felt positive about their prospects for technology-driven success in 2022.

The survey results clearly indicate that agents are successfully leveraging digital tools to enhance their customer service and increase their competitive advantage.

So what does this mean for the agent/broker model in insurance?

The survey indicates that the agent/broker model is alive and well, and in fact, it is thriving. Agents are embracing digital tools to better serve their clients, allowing them to more quickly and easily manage customer relationships.

Additionally, advances in technology have allowed agents to offer customers more options when it comes to purchasing insurance products – a trend that is expected to continue into the foreseeable future.

While digital technologies may have disrupted traditional business models, they are also providing opportunities for agents and brokers to stay competitive and offer their customers better service.

Digital tools are enabling the agent/broker model in insurance by offering more efficient processes and faster access to data – ultimately creating a win-win situation for customers and agents alike.

Insurance agency of the future: areas of focus for 2023

Digital tools and technologies are becoming indispensable for agents to remain competitive in an ever-changing insurance industry. Digital technologies can be seen as an enabler rather than a disruptor of the agent distribution model in insurance.

In 2023, insurance agencies should take advantage of opportunities to leverage technology, including:

Implementing digital quoting tools to make quoting processes faster and more efficient

Digital quoting is revolutionizing the agency model by offering customers improved efficiency and convenience. By streamlining the quoting process, agents can quickly provide quotes to clients with minimal effort on their part. This saves agents valuable time and resources that would otherwise be spent manually gathering and entering customer data. Additionally, digital quoting tools allow customers to compare different policies quickly and easily.

Utilizing analytics to gain insights into customer behavior

Insurance agencies can use data analytics to create a better understanding of customer needs and preferences. By utilizing predictive analytics, agents can predict customer behaviors in order to provide more tailored advice and products. Additionally, agents can use this data to develop marketing campaigns that are tailored to their customer base, further boosting policy sales.

Investing in telematics technology for fraud mitigation

Telematics technology allows agents to track customer behaviors via an installed device or app, allowing them to identify any unusual behavior that may indicate fraud. Additionally, telematics data can be used to provide customers with better rates and a more personalized insurance experience.

Streamlining back office tasks such as claims processing, underwriting, and policy servicing

Digital technologies can streamline operational processes such as claims processing and underwriting, allowing agents to quickly access customer data and process requests quickly. Additionally, digital tools can assist with policy servicing tasks such as premium calculations, renewals, cancellations, and more.

Transforming manual data intake processes to digital processes to save time and resources

Digital data intake processes allow agents to quickly and easily enter customer data into their systems, reducing the time spent manually gathering and entering information into internal systems, freeing up valuable resources.

Additionally, digital tools can help prevent errors by automatically verifying data at the point of entry and providing real-time feedback on mistakes.

Streamlining carrier communications by integrating with carrier APIs

Integrating with carrier APIs enables agents to quickly and easily communicate with carriers and access data in real-time. This eliminates the need for manual, time-consuming processes such as gathering data manually via paper forms and phone calls and can significantly reduce the amount of time spent on administrative tasks.

Enabling brokers to access more data sets quickly and efficiently to make informed decisions

Accessing data sets in real-time provides agents with the insights they need to make informed decisions quickly. By leveraging digital tools, agents can access multiple data sources at once and get an up-to-date view of their business operations. This allows them to identify opportunities for improvement and gain a competitive edge in the market.

Allowing agents to be more nimble and responsive to customer needs with no-code development

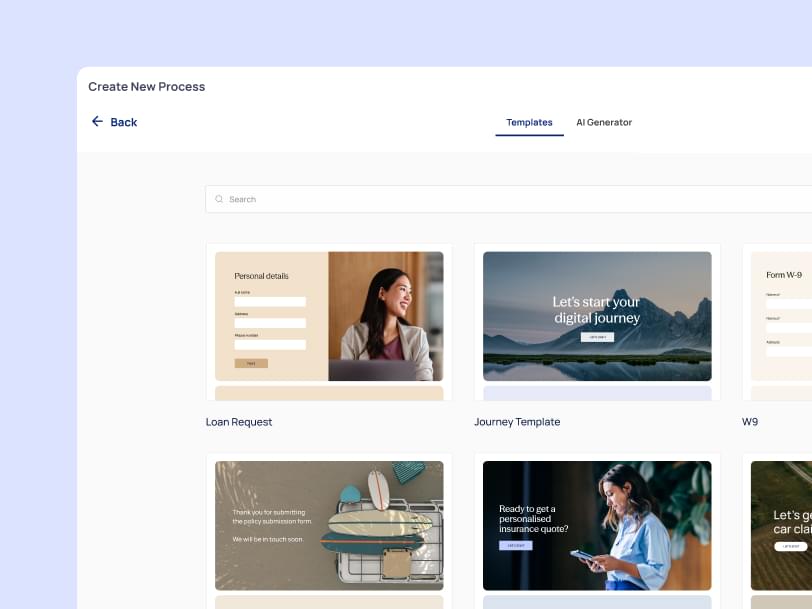

No-code digital solutions enable agents to quickly and easily create custom applications that meet their unique business needs. Agents can build automated processes, dashboards, and customer portals without having to write a single line of code. This allows them to be more agile and responsive when addressing customer requirements and building custom solutions.

Overall, digital technologies are proving to be an invaluable tool for agents and brokers to remain competitive in the ever-changing insurance industry. By leveraging these technologies to their fullest potential, agencies can continue to offer superior customer service while preserving their agent/broker model in insurance.