The insurance industry is having a bit of a rough time. Many insurance companies have faced elevated claims volume due to extreme weather events, COVID-19 pandemic, and civil unrest. At the same time, inflationary pressures have put further pressure on profitability.

The Millennials generation constitutes a new and growing group of recipients of insurance products, and insurers face a great challenge of tailoring their offers to the needs of young people who are not interested in traditional insurances. As premiums are surging higher and customer bases are getting younger, digital natives continue to be reluctant to initiate a relationship with an insurance company.

What's the solution?

Digital journey strategy is key when it comes to changing this state of things around. Or at least it should be.

What is an insurance digital journey?

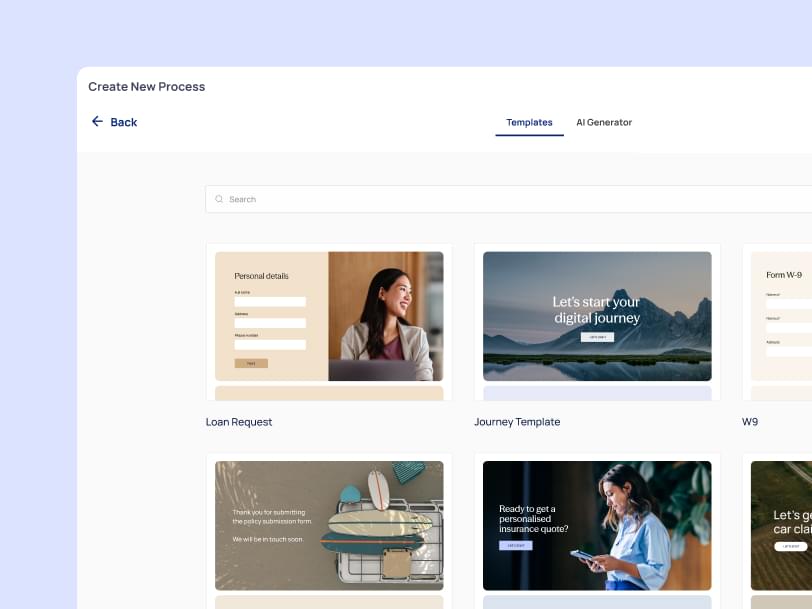

A digital journey is a planned and orchestrated series of digital customer interactions. These digital journeys can take place anywhere: on digital channels like websites and apps; at digital touchpoints like emails or push notifications; through digital portals like online accounts or self-service kiosks; via digital assistants like chatbots and digital agents.

Digital journeys are especially powerful when they are built for engaging with people, both new customers, and existing ones. This is where digital becomes an integral part of the marketing mix for insurance brands. Digital journeys are not a replacement for in-person interactions, and they are particularly effective when they're designed to support interactions between employees and customers.

In insurance, digital journeys can improve processes such as :

Customer Support: digital journeys can make it easier to find quick answers without in-person interaction, especially when all digital channels are integrated. This is a good way to reduce costs per call and improve customer satisfaction.

Claims: digital journeys have a huge potential to improve customer service with digital claims. In most cases, digital journeys are all about making the claims process simple and providing customers with digital tools that can help them prepare their claims.

Self-service: digital journeys aren't only designed for interactions between customers and employees but also for self-service platforms where customers can find digital tools to support the claims process on their own.

Online sales: digital journeys can be a great way to engage digital customers ready to purchase insurance online from your website. Not only do digital journeys provide ways for online sales, but digital channels can also be integrated with digital journeys to improve the customer experience and make it effortless on the buyer's side.

How do digital journeys boost ROI in insurance?

It's important to realize that digital journeys are built around the same principles, no matter what industry you're in. Depending on how they are used in the digital strategy, they might have some variations, but overarching principles of customer-centricity, great user experience, and seamless interactions remain the same.

But, if we know that digital journeys rule customer interactions and drive our digital strategy, what's next? How do digital journeys improve your ROI?

Let's take a look.

How do digital journeys cut your operational costs?

There are two ways digital journeys boost your ROI: by reducing operational and processing costs and by boosting your revenues.

1. Ditch the paperwork

If you ditch all forms, documents, and paper contracts, digital journeys can save a ton of operational costs by cutting down on processing time and reducing the need for employees to spend hours photocopying files, manually entering data into internal systems, and fixing errors.

You can enhance your digital journeys with artificial intelligence (AI) systems that can take over manual digital interactions and digital data processing, freeing your employees and saving your digital customers time. In fact, digital journeys can cut as much as 90% off your company's processing costs by eliminating data entry and processing overhead.

2. Reduce the volume of customer service requests

Self-service digital journey customer interactions are one way to significantly reduce the need for expensive call center operations. Giving your customers the power to complete simple actions such as updating their personal information, filing a claim, or submitting an application reduces the need for in-person interactions with your service staff.

3. Make better use of digital channels

The digital landscape has changed dramatically over the past few years, and digital journeys are making better use of them. Pre-digital, all applications had to be processed through call centers - which were costly in terms of labor costs. Now digital journeys are using digital channels more effectively by routing customer interactions via email or chatbots, which can filter out only those interactions that require personal attention.

4. Unify disjointed digital processes

Working with a digital journey platform instead of digital silos for each product is all about improving your ROI through cost savings. If you manage all your customer interactions via an end-to-end digital journey, you don't need to code, test, and implement separate technologies for every product and every stage in the journey- which cuts costs across the board.

5. Improve the quality of digital data

The better you treat digital customers through digital journeys, the more digital interactions you can have - which means the quality of digital data will also improve. Digital customer interactions provide valuable digital feedback that can positively affect your digital journey - and improvements can translate to increased digital conversions.

The digital journey will allow you to do more with less - digital journeys that decrease operating costs will increase your ROI across the board.

How do digital journeys grow your revenues?

6. Boost completion rates

Digital is about providing a seamless customer experience, so digital touchpoints are key. The more digital touchpoints you have to engage digital customers, the more digital interactions you can have with them - the more revenue opportunities will arise.

If you successfully digitize your customer journey, it means far more digital conversions. Digital interactions are good for driving digital sales.

7. Promote cross-sell and up-sell opportunities

Have you ever realized how much easier it is to sell insurance to someone who's already your customer? This is where digital journeys come in.

Digital journeys help you increase your digital footprint by promoting digital cross-selling across digital channels. Using digital journey mapping can predict which customers are most likely to purchase another product or extend their existing policy. You can also customize the digital journey -for example, by adding promotions for cross-selling offers on certain pages of the digital experience- to make the digital journey even more personalized.

8. Improve the customer experience

Digital journeys allow you to create digital experiences that are highly context-specific and best suited to your customers' profiles.

For example, suppose you want to upsell motorcycle insurance. In that case, you can send your digital journey across various digital touchpoints -apps, push notifications, or emails- so that it seamlessly fits into the digital experience your customer is already having.

The smoother your digital journey is, the less stress it will cause your customers - and if their digital journey is painless, they are more likely to convert into customers rather than walking away frustrated. Great digital journeys create satisfied digital customers who can become digital ambassadors for your brand.

9. Know what works for digital campaigns

The right digital journey can help you find out which digital experiences are more 'likely to convert' your customers. By following potential customers throughout their digital journeys, you can see whether or not they bought a certain product and when they bought it.

10. Guide digital communication

Digital journey mapping can be used to help you plan your digital communication -for example when you want to send promotions through certain digital channels in order to get the best return on investment (ROI). By following the customer throughout their digital engagements, you'll know where they are in their buying journey and if digital communication is the best way to communicate with them.

11. Gather intelligence and optimize performance

Digital journeys mean that you can start to gather digital intelligence (or digital data) about your digital customer journey - which means you can measure the performance of digital journeys, identify improvement opportunities and reduce churn through improved processes. Plus, digital journeys are a great opportunity to gather digital feedback - digital journeys provide customers with channels to give digital feedback, so you can improve your digital journey based on what customers are saying.

Getting started with digital customer journeys in insurance

Digital journeys are all about building a consistent overarching digital customer experience. When your touchpoints, interactions, data, and conversions are all integrated into one digital journey, it's more likely that digital customers will have a consistent digital experience with you.

Consistent digital experiences can make them feel loyal - or even put them in the position of advocating for your digital journey. Once digital customers begin to advocate for your digital journey, they're far more likely to increase digital interactions and digital touchpoints with you - which means digital conversions can go through the roof!

Learn about digitalization from our digital insurance experts. Find out where we could take any of your business or industry's digital journeys next. Get in touch with digital experts today.