Great user experience (UX) isn’t about bells and whistles. It’s about creating processes that are effortless to initiate, and where the user intuitively understands what he or she needs to do at every step along the way. Technology isn’t the driver in UX, but rather the ease of doing business and addressing new customer demands.

The banking industry wasn’t initially focused on the user experience. Traditionally, banking processes were driven by organizational logic, and customers were expected to accommodate themselves to the workflows of the bank. That often meant cumbersome forms, long waits, and inconvenient hours.

Customers today are no longer willing to accept those conditions, and banks have no choice but to meet the new demand or risk losing their customers to innovative new players. Customers now expect the same type of user-friendly experience from their bank that they have become accustomed to in the other aspects of their lives. That means more than a convenient banking app and website—it’s about personalization, the ease of doing business, and putting the customer first.

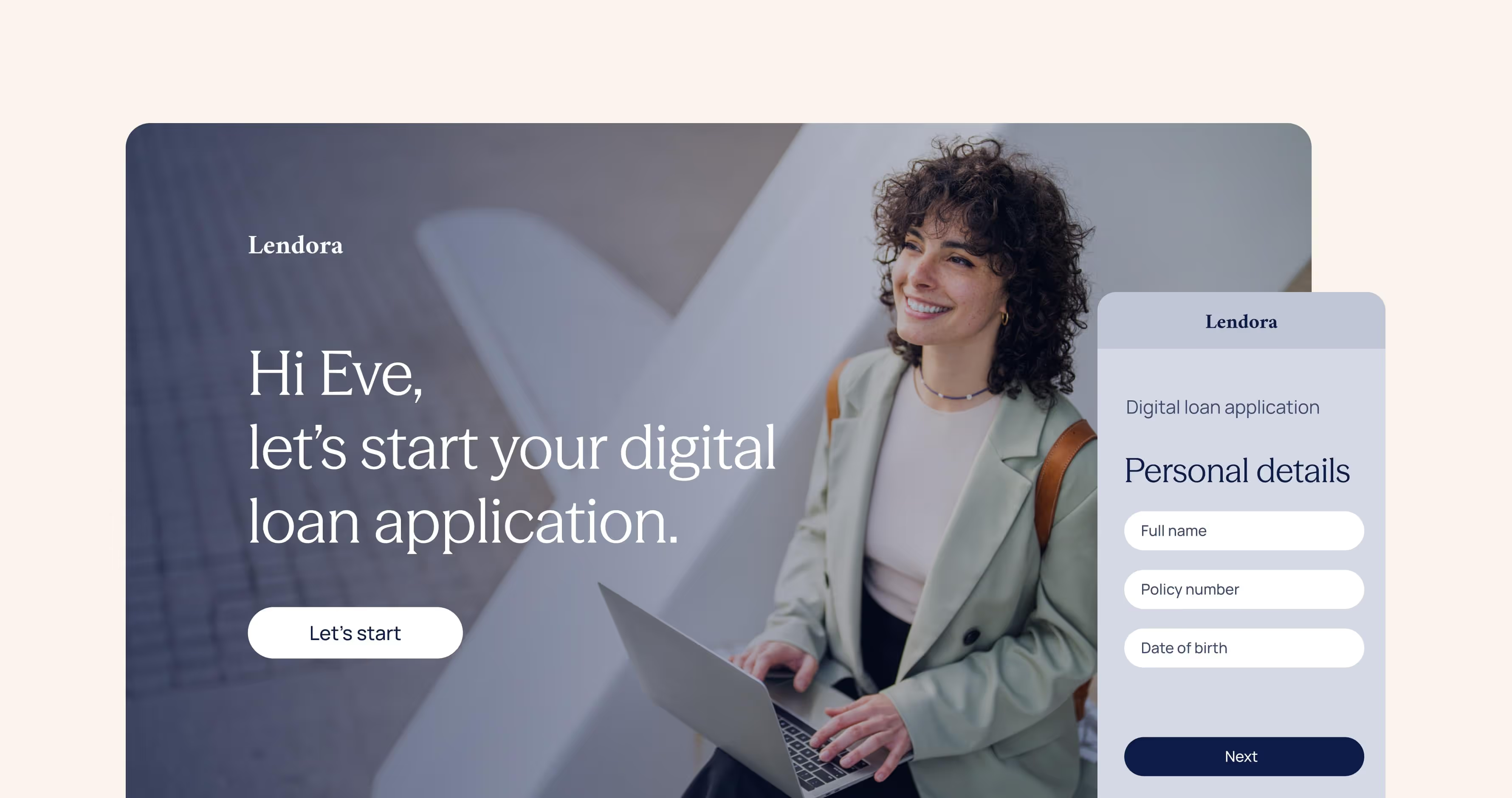

1. Replacing PDF forms with digital processes

One of the most important UX trends in banking for 2024 is the increasing focus on digital processes. Customers want to be able to do everything online, and they don’t want to have to go into a branch or call customer service unless it’s absolutely necessary.

But simply "going digital" is no longer enough. The process must be intuitive and easy to use, or customers will quickly become frustrated and look for another bank that can meet their needs.

To create a great digital experience, banks need to focus on creating processes that are simple and logical, with as few steps as possible. The goal should be to make it so easy that the customer doesn’t have to think about what he or she needs to do—it should be self-evident.

For example, PDF forms although still common tool for collecting customer data and eSignatures in banking, are detrimental to a good user experience. That’s because PDF format isn’t interactive—everyone sees the same form, no matter what their needs. That creates a lot of “clutter” for the user. Users see fields that are not relevant to them and often aren’t sure what to do and how to move forward. PDFs are also not mobile-friendly.

Digital processes, on the other hand, can be personalized according to the user’s specific needs, showing fields that are necessary and hiding ones that are not. They can utilize conditional logic and validations, showing fields according to the users' answers to previous questions. Those processes are also mobile-responsive.

But user-friendly digital forms are only the tip of the iceberg. Let’s look at some of the other banking UX trends we can expect to see throughout the year.

Using artificial intelligence for better UX

Artificial intelligence is quickly becoming one of the most important tools that banks use to improve their user experience. AI can help banks automate repetitive tasks, like customer service or fraud detection, and free up employees to provide a better experience for customers. AI can also be used to create personalized experiences for customers, like recommending products or services that they might be interested in. The possibilities are endless, and we can expect to see more banks utilizing AI to enhance their user experience in the coming year.

2. Chatbots and virtual assistants to amplify your workforce

The labor market is tight, and labor shortages and budget squeezes are making it difficult for banks to employ enough service agents to address all customer needs in real-time. Yet, in the increasingly digital world, people aren’t ready to wait for service. That’s why we can expect to see banks offering alternatives for human agents, assisting customers in transactions using AI-based chatbots and virtual assistants that have the capacity to provide a reasonable level of service for simple tasks.

Chatbots are rule-based computer programs that can engage 24/7. Although customers realize they aren’t communicating with a human, the automatic workflows can satisfy customer needs in simple interactions where a customer is looking to complete a specific action. They can answer customer questions, walk customers through processes, and even resolve problems using decision trees. They rely on machine learning to identify the right flow and provide answers to customers about whatever action they are interested in implementing.

Virtual assistants, like the popular Alexa and Siri, help people with day-to-day activities and utilize artificial emotional intelligence to make interactions playful and fun. While chatbots are text-based, virtual assistants are often activated and respond with voice. They don’t contain answers or perform activities on their own—instead they comb through existing resources, including chatbots, to find the answers the users are looking for.

However, implementation is key. There is nothing more frustrating than a chatbot going into a loop, not understanding what the customer is saying, or providing incorrect information. That’s why it’s important to have a plan and design chatbots with well-thought-out dialogue trees that consider all possible customer interactions, while making it simple for the customer to talk to a real human if they need to.

Although far from perfect, both chatbots and personal assistants can improve the user experience in banking. Chatbots are a fast way to solve common queries, and virtual assistants can help users access all types of information and make the banking process more personalized and friendly. We can expect to see both being used more frequently in banking in 2024 and enabling self-service options that were not possible in the past.

3. AI to drive personalized recommendations and financial planning advice

As mobile banking becomes more popular, we can expect to see more banks offering self-service options that were not possible in the past. This trend is being driven by the increasing use of artificial intelligence and machine learning, which are providing banks with the ability to offer more personalized and tailored services to their customers.

The banking industry is complex and offers a wide variety of services ranging from simple deposits and withdrawals to sophisticated investment platforms. Banks often want to showcase the variety of their services, but that can be a mistake. Customers get confused when they see too many options, especially when many of the options aren’t relevant to their needs or interests. It’s up to financial advisors to find the right options for every customer, but most banks simply don’t have sufficient human resources to do that effectively at scale.

In the past, self-service options were often limited to things like checking account balances and transactions. However, AI and machine learning are now being used to provide more complex services like financial planning and advice. AI's deep learning capabilities have enormous predictive and analytical powers that can help put the right opportunities in front of customers at the right time. That frees up human advisors from many of their rote monitoring tasks and lets them focus on client-facing activities and specialized interpretive roles. AI also improves over time, as it identifies more patterns.

[.figure]$34.72 billion[.figure]

[.emph]size of the global robo advisory market in 2028[.emph]

Artificial intelligence is also increasingly being used in automated trading models known as “robo-advisors”. As of 2024, the global robo-advisory market is forecasted to continue its significant growth trajectory. In 2023, the market size was approximately USD 8.74 billion, and it is projected to expand to USD 34.72 billion by 2028. This growth represents a compound annual growth rate (CAGR) of 31.78% during the forecast period. The robo-advisory services, which include automated, algorithm-driven financial planning with minimal human supervision, are increasingly being utilized across various sectors including retail banking and asset management.

The possibilities are endless, and we can expect to see more banks utilizing AI to enhance their user experience in the coming year.

4. Mobile banking will continue to grow and expand

[.figure]29%[.figure]

[.emph] of smartphone users will switch to another app or website if they fail to find what they are looking for within three seconds[.emph]

Smartphones have become central in our lives. It only makes sense that we increasingly look to our phones to perform financial transactions, driving a clear trend towards mobile banking, mainly features like in-app payments and person-to-person transfers. In the United States, 35% of households used mobile banking as their primary access method reached in 2019, and that number continues to grow.

Mobile banking is also growing in the developing world, where access to banking services is often limited. In Africa, for example, mobile money services are being used to provide banking services to people who don’t have access to traditional banking infrastructure. These services allow users to store money on their phones and use it to pay for goods and services or send money to other people. This trend is likely to continue as mobile money services become more widespread and integrated into the mainstream financial system.

While we can expect mobile banking to continue to grow in popularity, it’s important to note that not all features are equally popular with users. In fact, a 2019 study found that the most popular mobile banking features were relatively basic, with people primarily using their phones to check account balances and transactions, transfer money, and pay bills. This suggests that there is still room for growth in terms of the features offered by mobile banking apps. As more people use their phones as their primary banking interface, we can expect to see new and advanced features and capabilities being added to meet evolving customer needs.

Recent research shows that 29% of smartphone users will switch to another app or website if they fail to find what they are looking for within three seconds. UX designers have to be aware of this and design accordingly. Another study showed that 61% of people would not return to a website if it was too slow or if they had trouble using it from their mobile phone. Creating a responsive design is crucial for delivering an optimal experience to users, no matter what device they are using.

5. The rise of biometrics in mobile banking

One of the most important trends in banking is the increasing use of biometrics for authentication. This technology, which uses physical or behavioral characteristics to identify individuals, is seen as a more secure alternative to traditional passwords and is already being used by many banks and financial institutions.

This trend is expected to make mobile payments so convenient that customers will no longer want to use any other payment method.

We can expect to see biometrics being used more frequently in banking in 2024, as banks look to improve the mobile banking experience and make it more convenient for users. In particular, we expect to see the use of fingerprint scanning and facial recognition for authentication purposes. These technologies offer a high level of security while being much easier to use than traditional security methods like passwords.

6. Expanding offerings to include cryptocurrency wallets and investment products

Banks have been hesitant to enter the volatile world of cryptocurrency, but as blockchain finance grows in popularity, banks are beginning to dip their toes into the crypto water. The customer demand for crypto can’t be ignored, and it’s driving many banks to offer customers tools like crypto wallets, where they can store the private keys for cryptocurrency transactions. Other banks are offering bitcoin custody services and crypto investing packages.

Bitcoin credit cards are also becoming more popular as a way to spend cryptocurrency. These cards are linked to bitcoin wallets and allow customers to make purchases with their crypto holdings.

As various third-party providers offer customers more investment products like Exchange Traded Funds (ETFs) and other types of curated portfolios, banks are doing the same in order to remain competitive. This trend seems to be gaining steam and is likely to continue going strong throughout the year, especially as the global economy continues to be very volatile.

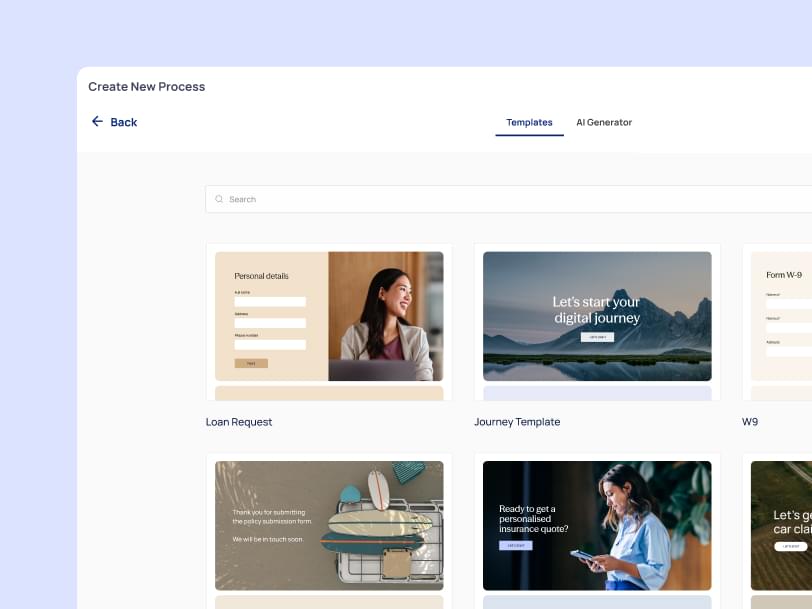

7. Boosting UX with no-code development

Banks increasingly understand that it’s not about them, and that an excellent user experience is key to remaining competitive. In 2024, that includes a focus on mobile banking, AI, and new products and services. But one trend that’s often overlooked is the role of no-code in banking. No-code platforms allow anyone to build custom apps without having to write a line of code. That means that banks can quickly develop and deploy new features and integrations without having to rely on expensive and scarce developers.

[.emph]No-code is particularly well suited for building customer-facing apps, such as mobile banking apps, chatbots, and robo-advisors. It’s also useful for automating back-office processes like fraud detection and KYC/AML compliance.[.emph]

Banks that embrace no-code will be able to move faster and be more agile in the face of change.

Focus on UX in all aspects of banking

Banks are starting to offer a variety of new products and services in order to keep up with the competition and meet the needs of their customers. In particular, we expect to see an increased use of digital intake methods, biometrics for authentication, AI powered chatbots, personalized investment products, and accelerated digital transformation driven by no-code development platforms. These technologies will help banks improve the user experience and remain competitive in the years to come.